Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

CIT Bank No-Penalty Certificate of Deposit

- Our Rating 4.5/5 How our ratings work

- Minimum

Deposit Required$1,000 - 11-Month APY3.50%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's No-Penalty CD are variable and subject to change at any time without notice.

CIT Bank's No-Penalty CD offers one of the most competitive rates with no early withdrawal penalty on the market. With this account, you can earn a 3.50% APY, and the CD matures in just 11 months, which is shorter than average.

High Interest With Low Risk

If you’re using a CD as an emergency fund or you’re concerned that you might need access to your savings before a traditional term CD matures, then a no-penalty CD may be what you’re looking for. The CIT Bank No-Penalty CD is a strong option that offers higher-than-average rates at 3.50% APY on their 11-month CD. If you want both the flexibility of withdrawing funds before the term matures and a higher interest rate, then the CIT Bank No-Penalty CD is worth considering.

Pros

- Strong APY for a no-penalty CD

- No opening or maintenance fees

Cons

- Relatively high minimum opening balance

4 Best No-Penalty CD Rates in May 2024: Earn Up to 4.70% APY

CIT No-Penalty CD Overview

The CIT No-Penalty CD is like your typical CD account. It's FDIC insured, and it matures over a pre-agreed amount of time — in this case, 11 months. It can also help you build an emergency fund, save for an upcoming project and lock in your guaranteed interest rate.

- Term Maturity: 11 Months

- Minimum Opening Balance: $1,000

- Opening or Maintenance Fees: None

- Early Withdrawal Fee: None.

Benefits of the CIT No-Penalty CD

Where the CIT No-Penalty CD differs is that it doesn’t charge you an early withdrawal, or penalty, fee.

Let’s say you deposit $1,000 into your no-penalty CD, but suddenly, you go to the emergency room and have no money to pay for treatment. You can withdraw funds whenever you like from your CIT No-Penalty CD without paying a fee.

Here are some additional details to know about the CIT Bank No-Penalty CD:

- Funds can be withdrawn after 7 days of account funding: The only caveat is that you need to wait until your no-penalty CD has been active for seven days to make a withdraw. If you’ll need your money within the first six days of account opening, you will end up paying a penalty.

- No opening or maintenance fees: Additionally, CIT won’t charge you opening or maintenance fees either.

- Daily compounded interest: Plus, you’ll get daily compounding interest on your funds, maximizing your earning potential.

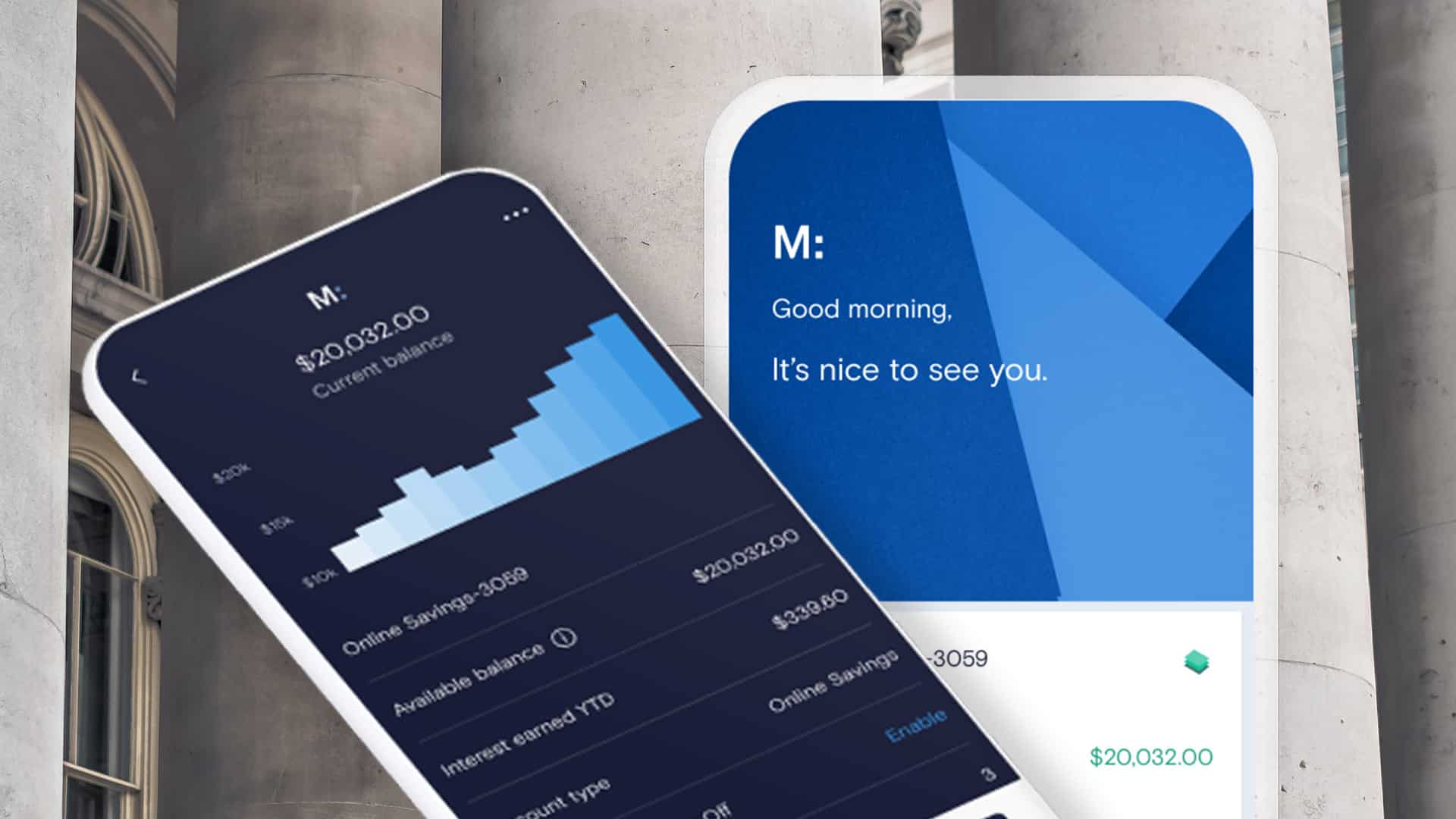

- Around-the-clock access: You can access your account 24/7 on your CIT Bank mobile app or your desktop computer.

- FDIC insured: Your account is federally insured up to $250,000, so you can be confident that your funds are safe up until that amount.

Drawbacks

A CD is going to be ideal for you if you want a low-risk way to gain interest on your money. If you like to take high risks, then a CD is not for you. While the interest rate of your CD won’t go down, it also won’t go up if the interest rates in general increase. You may be missing out on gaining even more interest on your funds.

If you'd like more flexibility with rate changes, you might be better off with a high-yield savings account. Here are a few of our favorites.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.25%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

|

0.50% - 4.60%

Customers earn 4.60% APY on savings balances when they set up recurring monthly direct deposit of their paycheck or benefits provider via ACH deposit. Alternatively, deposit at least $5,000 each month to earn 4.60% APY on your savings balance. Checking balances earn 0.50% APY |

No minimum deposit |

Open Account |

|

|

5.05%

Earn 5.05% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

|

|

4.65%

Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Savings Connect account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

What to Do When Your CD Matures

Once you reach the 11-month mark, you can either roll your funds into another CD for the same duration or a different term, or you can cash it out. There are no fees for whatever you choose.

CIT Bank Term Certificates of Deposit

- Our Rating 3.5/5 How our ratings work Read the review

- Minimum

Deposit Required$1,000 - 1 Year APY0.30%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 3 Year APY0.40%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 13-Month APY3.50%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

Many banks that offer CDs require customers to commit to lengthy terms of several years or more in order to earn the highest interest rates available. However, with CIT Bank's term CDs, the opposite is true. To get the best rates at CIT, you'll need to open one of its shorter-term CDs, such as its 13-month CD that pays 3.50% APY. If you want an easy way to save more money without having to wait years, CIT Bank's term CDs are a solid option.

CIT Bank offers a variety of term CDs ranging from six months to five years. Each CIT Back CD APY varies depending on the term length of your certificate of deposit.

CIT Deposit Account Comparison

While savings accounts or money market accounts are safe as well, their interest rates are typically lower, so a CD is a better choice if you want a higher APY. After you make your initial deposit, you cannot add money to your CD, however, like you could with a money market or savings account.

| Savings Connect | Platinum Savings | Money Market | Savings Builder | Term CD | No-Penalty CD | eChecking | |

|---|---|---|---|---|---|---|---|

|

APY |

4.65% |

Up to 5.05% |

1.55% |

1.00% |

Up to 3.50% |

3.50% |

0.10%-0.25% |

|

Minimum Opening Deposit |

$100 |

$100 |

$100 |

$100 |

$1,000 |

$1,000 |

$100 |

|

Monthly Fee |

None |

None |

None |

None |

None |

None |

None |

|

Learn More |

|||||||

|

Open Account |

How to Open a CIT Bank No-Penalty CD Account

If you think the CIT No-Penalty CD is right for you, log onto CIT’s website, hit “Start Now” and fill out an application. You’ll need to provide your primary home address, a valid email address, a valid phone number and a Social Security number. Additionally. you'll also need to fund the account with a minimum opening balance of $1,000. You can transfer funds into your new CD by electronic transfer, mail-in check or wire.

The CIT No-Penalty CD could be an option if you want to safely store your money in an interest-bearing account. And if a situation arises where you need to make a withdrawal, there’s no need to worry about a penalty.

Ready to Open a CIT Bank No-Penalty CD? Start here.