Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Ink Business Cash® Credit Card

- Our Rating 4.5/5 How our ratings work

- APR18.49% - 24.49% (Variable)

- Annual Fee$0

-

Sign-Up Bonus

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

Business owners looking to earn a high rate of cash back on common business expenses like office supplies and internet could get a lot of value from this card. The trade-off for the high cash-back rate, though, is a lower spend cap than you’ll find with other Ink Business cards.

A No-Annual-Fee Small Business Staple

The Ink Business Cash® credit card is a popular business credit card for small businesses, sole proprietors, and freelancers who don’t want the burden of an annual fee. Cardholders can earn 5% back on day-to-day expenses that keep their businesses running, like office supplies and telecommunication services. Not only that, but you can earn 2% back on gas stations and restaurants. It also comes with a competitive introductory bonus offer of up to $750 for new cardholders: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. Plus, if you have another Chase card that earns Ultimate Rewards® points, you can potentially earn much more by transferring your rewards into points with Chase’s multiple travel partners.

Pros

- No annual fee

- 5x back on a broad array of business spending categories

- Robust travel and purchase protections

- Don't need a full-fledged business to apply

Cons

- Businesses that don't spend on the category bonuses won't benefit

Card Highlights

- Earn up to $750 in bonus cash back: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

- Each account anniversary year, you'll get 5% cash back on the first $25,000 you spend at office supply stores and on internet, cable, and phone services.

- Each account anniversary year, you'll get 2% cash back on the first $25,000 you spend at gas stations and restaurants together. On all other purchases, get 1% cashback.

- Through Chase Ultimate Rewards®, you can use your rewards to get cash back, gift cards, travel, and more.

- There is no annual fee

- The introductory APR on purchases is 0% for first 12 months. After that, 18.49% - 24.49% (Variable) APR applies.

- Free cards for all employees, so you can earn cash back faster.

What Our Credit Card Experts Are Saying

“The Ink Business Cash Credit Card’s 5% cash back at office supply stores can be a backdoor to earning 5% on almost every spending category, including dining, fuel, travel, clothing—everything. When I purchase gift cards from Staples and Office Depot, I get 5% back rather than the 2% to 3% of most cards. The best part is, during promotional periods, I can snag prepaid Visa gift cards with zero activation fees, which pretty much gives me a discount on cash.

“I highly recommend bundling available services with your cellphone provider to maximize the 5% cashback on internet, cable, and phone service providers. So, I’ve added streaming services and even a home security system through my provider to take full advantage of the 5% back. ”

Sign-Up Bonus

The Ink Business Cash credit card has a sizable sign-up bonus offer for new card members.

- You can earn up to $750 in bonus cash back: Earn $350 when you spend $3,000 on purchases in the first three months, plus an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

You can redeem your cash-back rewards for cash back, travel gift cards and more through Chase’s popular rewards program, Chase Ultimate Rewards.

Earning Rewards

The Ink Business Cash credit card is one of the premier business cash-back cards on the market. It offers accelerated cash back in several bonus categories that align with most businesses’ budgets. Here’s a look at the Ink Business Cash card’s current rewards rates:

- 5% cash back on the first $25,000 spent in combined purchases at office supply stores and internet, cable and phone services each account anniversary year.

- 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year.

- Unlimited 1% cash back on all other purchases.

- You’ll earn cash back for your business regardless of the spending category. With free cards for all of your employees, they’ll earn you cash back for purchases, too.

The cash-back points you earn never expire as long as your account remains open. That means you can use your cash-back rewards as you earn them or save them up and redeem them later.

Redeeming Rewards

Although many cardholders prioritize getting cash back, Chase Ink Business Cash provides a number of flexible redemption options to choose from. Even though it's a cash rewards card, you earn Ultimate Rewards points that you can redeem for:

- Travel through the Chase portal.

- Cash deposited into a bank account.

- A statement credit on your account.

- Purchasing gift cards.

- Shopping with points at Apple and Amazon.

In most circumstances, each of your points is worth 1 cent.

Transferring Points

You can transfer your points to another Chase card if you have one. By doing so, you could get enormous value for your points when redeemed for travel.

However, to transfer points, you'll need another Chase card that earns Ultimate Rewards points and allows for point transfers to airline and hotel partners. The Chase Sapphire Preferred®, Chase Sapphire Reserve®, and Ink Business Preferred® cards are examples of cards that support this feature.

Quick Tip

Your points are worth even more if you hold one of the following Chase cards:

- 25% more points with the Chase Sapphire Preferred® Card.

- 50% more points with the Chase Sapphire Reserve®.

- 25% more points with the Ink Business Preferred® Credit Card.

If you hold any of the three cards above, you can also transfer your points to a Chase airline or hotel partner. This is perhaps the best potential deal of all. This list travel partners includes:

- Aer Lingus

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards®

- Flying Blue Air France/ KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

- IHG® Rewards Club

- Marriott Bonvoy®

- World of Hyatt®

Here’s an example of how transferring points earned with Ink Business Cash works:

- Let's assume your business spends the full $25,000 limit each year in Ink Business Cash's 5% bonus categories. You would earn an impressive $1,250 in cash back or 125,000 Ultimate Reward Points.

- But if you transfer those points to another Chase card, your points multiply if you use them to book travel through the Chase Travel℠ portal.

- Building on the scenario above, your reward earnings would be worth up to 187,500 Ultimate Reward Points if you also carry the Sapphire Reserve card.

How to Maximize Point Redemptions With Gift Cards

Want to boost the value you get out of your new Ink Business Cash card? The Chase Ink Business Cash is currently one of the best credit cards for buying gift cards because you can maximize your rewards value through office supply store gift cards (which is one of the card's bonus categories).

Let's imagine you own a lawn care service. You must purchase $500 worth of supplies from your local home improvement store. If you take a trip to Lowe's to buy what you need, you'd earn 1% cash back with your Ink Business Cash card. But because Ink Business Cash offers 5% cash back at office supply stores (up to $25,000 spent per year), if you first visit an Office Max and buy a $500 Lowe's gift card, suddenly, your purchase becomes worth five times the rewards.

Just be aware that you should use this strategy with caution. Card issuers can take back your rewards if they think you're abusing the system.

Card Benefits and Perks

Beyond earning rewards, the Ink Business Cash credit card comes packed with other valuable perks business owners will love. Cardmembers will enjoy several business and travel-related benefits, including:

- Free employee cards: Enjoy complimentary credit cards for your employees. You’ll earn the same rewards rates with each card you open. You can also set spending limits on each card.

- Business reports: Chase gives your business 24/7 access to valuable reports to help you track expenses and more. Reports include monthly statements up to 24 months, quarterly reports, and more.

- Bookkeeping integration: Your Chase Ink card account easily integrates with popular bookkeeping software, allowing you to track expenses and maintain detailed tax-related records.

- Purchase protection: With the Ink Business Cash credit card, your purchases are covered for up to 120 days against damage and theft. There’s a $10,000 limit per claim and $50,000 per account.

- Extended warranty protection: Any purchases that come with an eligible U.S. manufacturer’s warranty of three years or less will receive an extra year of coverage when you pay with your Ink card.

- Car rental collision damage waiver: Car rental purchases made with your Ink Business Cash credit card receive auto rental collision damage coverage. You’ll need to decline the rental company’s coverage to qualify.

- Assistance services: Cardmembers can also access travel and emergency assistance services. Note that you are responsible for any costs related to services and goods received.

- Roadside dispatch: You can access roadside assistance via Chase as a card member. Services include towing, jumpstarts, tire changes, lockout service, gas delivery and more. Remember, there are charges for these services, which are explained before you agree to receive any of them.

Drawbacks

Even though the Chase Ink Business Cash card has several advantages and perks, there are also a few drawbacks to consider. This is what you need to be aware of:

- Limited high-earning categories: The combined annual cap for the 5% and 2% cash-back categories is $50,000, so if you spend more in those bonus categories, you'll only get 1% cash back on subsequent purchases.

- 5% categories might not fit your business spending: The main benefit of using this card is lost if your company spends a small amount on office supplies or cable-internet-phone services.

- Poor choice for international businesses: The card has a 3% foreign transaction fee, which makes it less practical for businesses that frequently transact with or travel abroad.

- No travel perks: Unlike other business credit cards, there are no travel-specific benefits like free checked bags or airport lounge access.

- Potentially high APR: Although the card offers an introductory APR of 0% for first 12 months on purchases, the regular 18.49% - 24.49% (Variable) APR after that can be high, especially for businesses with less-than-ideal credit. If you carry a balance from month to month, this could be expensive.

Annual Fee

Ink Business Cash credit card carries no annual fee. You benefit from rewards earning and other perks without any extra out-of-pocket costs for you or your business.

Intro APR

Another perk included with the Ink Business Cash Credit Card is an introductory APR offer. Cardmembers enjoy an introductory APR of 0% for first 12 months on purchases, after which a variable 18.49% - 24.49% (Variable) APR applies, based on your creditworthiness.

This allows you to make large purchases for your business and pay them off over time without incurring interest charges. Remember to make minimum monthly payments, or your account switches to the default APR. You must also pay off those purchases during the introductory period, or you’ll pay interest.

Keep in mind that the introductory APR offer doesn’t extend to balance transfers.

Regular APR

Following the introductory period, the Ink Business Cash credit card charges a 18.49% - 24.49% (Variable) variable APR based on your creditworthiness. APRs fluctuate throughout the year as card issuers adjust rates to the market. The variable APR is comparable to other business credit cards.

Other Fees

We mentioned that the Ink Business Cash doesn’t have an annual fee, but you could face other fees when you use your card.

Unfortunately, with a 3% foreign transaction fee on all international purchases, the Ink Business Cash card isn’t a great option for individuals who frequently travel outside the U.S. You are better off saving your Ink card for other purchases. You can pair it with another travel rewards credit card that doesn’t charge foreign transaction fees for international business trips.

Related Article

Related Article

Chase Travel Rewards: Guide to Chase Ultimate Rewards

Recommended Credit Score

Even with business credit cards, your personal credit and credit score matter to credit card issuers. You’ll be asked to supply personal information during the application process and be subject to a hard credit inquiry.

Most credit card issuers don’t publicly disclose credit score requirements to qualify for specific cards. The Ink Business Cash credit card is designed for people with good to excellent credit scores (670-850).

Knowing your current personal credit score can help you as you explore new credit cards for your business. There are three major credit bureaus in the US, and you can check and monitor your credit scores for free. Using a free service like Experian Boost can help increase your credit score.

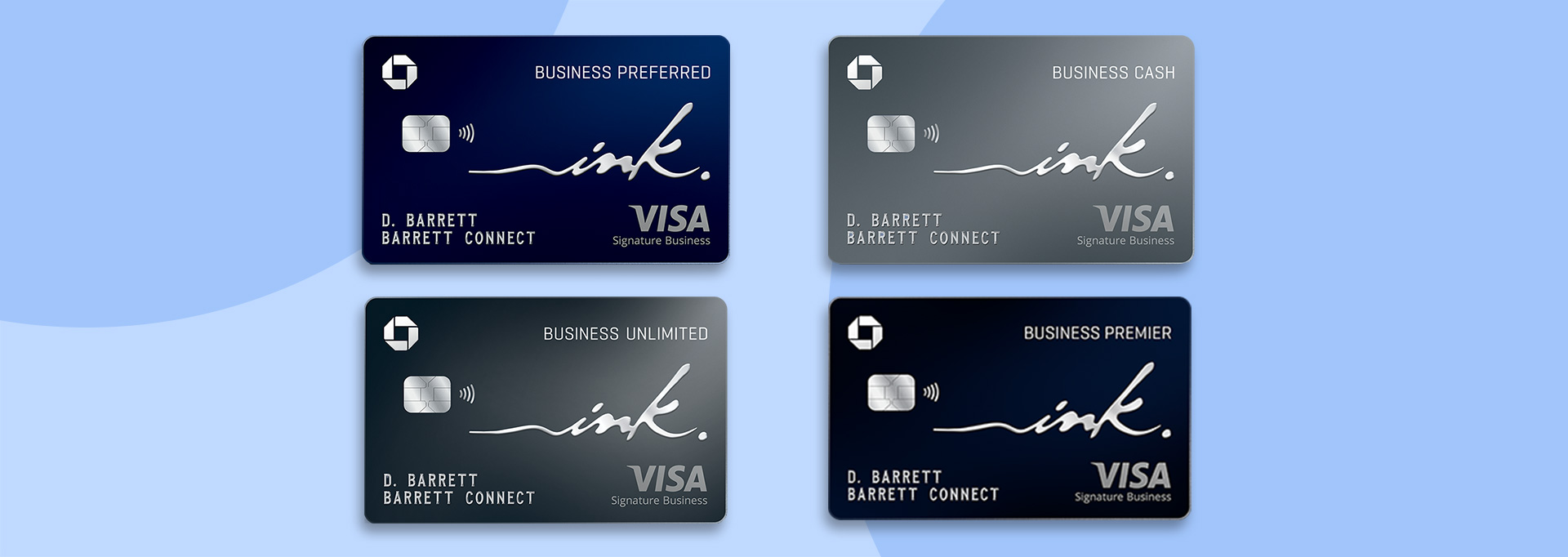

Comparing Ink Business Credit Cards

This card also isn’t the only member of the Chase Ink family. Chase offers a suite of Ink business cards to meet various business needs. Here is a quick look at the Ink business cards and how they stack up.

Compare Chase Ink Business Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

|

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening |

$0 |

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

Apply Now |

|

|

$750Cash Bonus

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening |

$0 |

1% - 5%Cashback

Earn 5% cash back on your first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. It also offers you 2% cash back on your first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. |

Apply Now |

|

|

100,000Chase Ultimate Rewards Points

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,300 (100,000 Chase Ultimate Rewards Points * 0.023 base) |

$95

This fee includes extra cards for authorized users, such as employees, at no additional charge. |

1x - 3xPoints

Earn 3x points on the first $150,000 of combined spending in a number of key business categories |

Apply Now |

|

|

$1,000Cash Bonus

Earn $1,000 bonus cash back after you spend $10,000 on purchases in the first 3 months from account opening. |

$195 |

Up to 2.5%Cashback

Earn unlimited 2.5% total cash back on purchases of $5,000 or more and unlimited 2% cash back on all other business purchases. |

Apply Now |

Ink Business Cash® Credit Card vs. Ink Business Preferred® Credit Card

If you can get close to spending the maximum amount on office supplies, internet, cable and phone services, the Ink Business Cash program is an ideal way to earn cash rewards. However, regarding redemptions, the card's predecessor, the Ink Business Preferred® Credit Card, is superior.

With the Ink Business Preferred card, the first $150,000 spent on travel and specified business categories earns three points per dollar, while all other purchases earn one point. Even better, each point is worth 1.25 cents when redeemed for travel through the Chase portal, as opposed to just 1 cent with Ink Business Cash.

You can also transfer your cash rewards to any number of airline and hotel loyalty programs that are Chase partners. If you transfer your points to an airline's loyalty program and use them to book business-class travel, your rewards can be worth much more.

Keep in mind that the Ink Business Preferred card has an annual fee of $95, but the Business Cash card does not have an annual fee.

Ink Business Cash® Credit Card vs. Ink Business Unlimited® Credit Card

If you don't want to deal with the hassle of tracking your spending categories, consider the Ink Business Unlimited® Credit Card. It offers a flat rate of 1.5% cash-back rewards on all business purchases, with no bonus categories to wrestle with. You'll also enjoy the card's introductory APR of 0% for first 12 months, after that a 18.49% - 24.49% (Variable) APR applies.

The card's name implies that there will be no limits on the amount of cash back you can earn when using it. The Ink Business Unlimited card is a straightforward rewards credit card with no annual fee, which can be very tempting. It can be used alone or with another card offering category bonuses. But unlike the Ink Business Preferred, you can't leverage the Chase travel portal to get more out of your redemptions or transfer rewards to travel partners.

Is the Ink Business Cash Right for You?

If you're looking for a new business rewards credit card with no annual fee and higher rewards spending categories your business frequently uses like office supplies, utilities, gas stations or restaurants, the Ink Business Cash card can be a great option. Its 5% rewards rate in bonus categories is hard to beat, especially on a card with no annual fee. Aside from one hard credit inquiry that may or may not affect your credit score when you apply, it's hard to see any downside to adding such a valuable rewards card to your wallet. The upside, on the other hand, could be significant.

Ready to Get Started?

Frequently Asked Questions

-

The Chase Ink Business Cash can be hard to get, as it typically requires applicants to have a good to excellent credit score, usually above 670. Other factors influencing approval include the applicant's business revenue, credit history, and existing relationship with Chase. Additionally, Chase is known for its 5/24 rule, which means your application may be automatically denied if you have opened five or more credit card accounts in the past 24 months. While it can be challenging for some applicants, having a strong credit profile and a well-established business can increase your chances of being approved for the Chase Ink Business Cash card.

-

The Ink Business Cash may be worthwhile for many small business owners, particularly those who can take advantage of its 5% cash back on office supply store purchases and internet, cable, and phone services (up to $25,000 combined annually) and 2% cash back on gas station and restaurant expenses (up to $25,000 combined annually). With no annual fee and a generous welcome bonus, the card provides value without additional costs. Furthermore, the card's versatility in redeeming rewards as cash back, statement credits or transferring points to other Chase cards for travel or other rewards makes it an appealing choice. To determine if Ink Business Cash is best for you, consider your company's spending habits and needs.

-

Yes, the Chase Ink Business Cash card earns Ultimate Rewards points on every purchase made with the card. These points can be redeemed for cash back, gift cards, travel bookings or even transferred to other Chase cards that offer travel rewards, such as the Chase Sapphire Preferred, Chase Sapphire Reserve or Ink Business Preferred cards, which allow for point transfers to airline and hotel partners for potentially greater value.

-

The average credit limit for the Chase Ink Business Cash card depends on the applicant's creditworthiness, business revenue and relationship with Chase. While no specific average credit limit is published, it typically ranges from a few thousand dollars to tens of thousands of dollars. Applicants with higher credit scores, a strong financial history and an established relationship with Chase are likelier to receive higher credit limits. Keep in mind that credit limits are subject to change based on your usage patterns, payment history and overall credit profile.

-

To increase your chances of getting approved for the Ink Business Cash card, maintain a good to excellent credit score, usually above 670, and a solid credit history. Ensure your business's revenue and financials are strong, as Chase will consider these factors during the application process. Also, fostering an existing relationship with Chase, such as having other accounts or credit products with them, can improve your chances. Be sure to provide accurate and complete information on your application to ensure a smooth approval process.

-

Chase has an unofficial rule known as 5/24. The 5/24 rule makes it so you can't qualify for a new Chase card if you have opened five or more credit cards in the last 24 months. However, this rule often doesn't apply to business credit cards (as long as they don't appear on your personal credit reports). So, the Ink Business Cash probably won't count toward your Chase 5/24 total.

-

Wondering if you can qualify for a business credit card? In general, if you sell goods or services to others, you're probably eligible. Those goods and services might include freelance work (photography, tutoring, or childcare), online sales (like eBay or Amazon), ride-sharing and more.

If your business isn't registered as an LLC or corporation, you can still complete business credit card applications under your name as a sole proprietor. You'll need to supply your Social Security number when asked. (Note: Even if your business is officially registered, you'll likely need to provide your SSN, along with your Employer Identification Number (EIN), to apply for a new account.)

Although you're applying for a business credit card, your personal credit will also be checked. So, it's wise to check your three consumer credit reports from Equifax, TransUnion and Experian before you apply. Make sure they're error-free and in good shape. You can check your credit reports for free once every 12 months at AnnualCreditReport.com.

-

A business credit card might help build a margin into your cash flow if business funds are tight. In other words, buy what your business needs now and use the extra time to collect business payments before your credit card bill is due. However, you should be very careful with this approach. It's a slippery slope. Never charge more than you can afford to pay off by your next due date. Otherwise, your business credit scores might suffer, and you could waste money on interest.