Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

CIT Bank Savings Builder Account

- Our Rating 3/5 How our ratings work

- APYUp to 1.00%

Earn 1.00% APY by maintaining a balance of $25,000 or more, or by receiving a single deposit of $100 or more each month. Annual Percentage Yield is accurate as of September 22, 2022. Interest rates for the Savings Builder account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 - Intro Bonus N/A

While it doesn't offer an especially strong interest rate, many of the features included in CIT Bank's Savings Builder account are designed to encourage you to save. To earn the maximum APY on this account, you need to either maintain a high account balance or regularly make deposits, both of which incentivize responsible saving.

Designed with Responsible Savings in Mind

If you’re ready for your hard-earned money to work even harder for you, the CIT Bank Savings Builder pays a healthy APY (average percentage yield) when account holders make either a qualifying monthly deposit of $100 or more or maintain a $25,000 minimum balance. The current CIT Bank APY is a 1.00% rate of return on your savings.

Pros

- No monthly fee

- Daily compounding interest

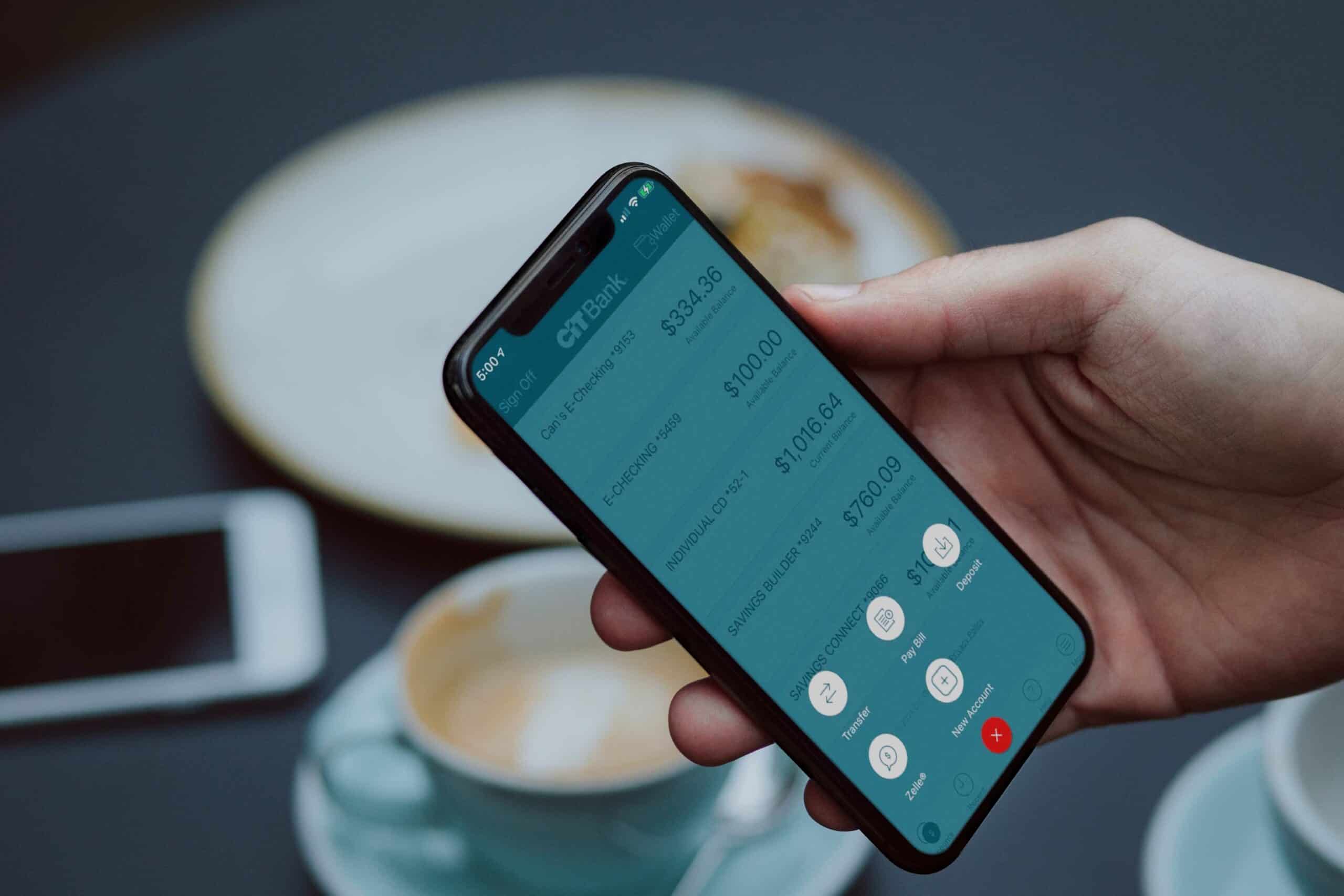

- Access to CIT Bank's mobile app for banking on-the-go

Cons

- Top APY is not especially competitive

- Extra requirements to earn maximum APY

- Minimum opening balance requirement

If you’re ready for your hard-earned money to work even harder for you, the CIT Bank Savings Builder pays a healthy APY (average percentage yield) when account holders make either a qualifying monthly deposit of $100 or more or maintain a $25,000 minimum balance. The current CIT Bank APY is a 1.00% rate of return on your savings.

Features

The CIT Savings Builder account offers a high yield that's 8 times the average you can get elsewhere in the U.S. So if you're looking for a place to put your emergency fund, down payment fund or other short-term savings, the Savings Builder can be an excellent way to get more value out of your savings balance.

If you're also looking for a checking account, the bank's eChecking account offers a solid interest rate, ATM fee reimbursements and more. Before you apply with CIT Bank, though, make sure you research and compare multiple options to make sure you find the right fit, especially online banks — and that includes CIT Bank's money market account.

Types of Savings Builder Accounts

CIT Bank’s Savings Builder are interest-bearing savings accounts with tiered interest rates. The interest you accrue is compounded daily and credited to your account on a monthly basis. CIT Bank offers two types of Savings Builder accounts that qualify for the current 1.00% APY:

- High-Balance Savers Account: Must maintain a balance of $25,000 or more.

- Monthly Savers Account: $100 minimum deposit to open the account, and a $100 monthly deposit after that.

That's comparable or even better than some CD rates. If you don't meet one of those requirements, you'll earn an APY of just 0.40%. Just keep in mind that the bank’s APYs are variable and subject to change without notice.

APY and Tiered Interest

Earning a 1.00% APY may not sound like a lot. But that rate is markedly better than the national savings rate.

You'll earn 0.40% interest on balances less than $25,000. However, that APY soars to 1.00% when you have a monthly deposit of $100 more. It pays to save. Similarly, balances of $25,000 or more also earn 1.00% APY without needing a $100 or more monthly deposit. So, a Savings Builder account is a good place to earn high interest on a chunk of your savings without worrying about monthly deposits.

As SlicksterDealer points out, “CIT opens a new type of account with a better interest rate about every year and starts dropping the interest rates on their existing accounts. So watch the interest rate like a hawk.”

| Tier | APY | Interest Rate |

|---|---|---|

|

less than $25,000 |

0.40% |

0.250% |

|

less than $25,000, but with monthly deposit of $100 or more |

1.00% |

0.995% |

|

$25,000 or more |

1.00% |

0.995% |

Also, the account technically gives you a 1.00% APY from the day you open your account until your first "Evaluation Day," regardless of whether you qualify for that rate based on your balance or monthly deposits.

The Evaluation Date occurs at the end of your first "Evaluation Period," which begins on the third business day prior to the end of the month after the month of account opening and ends at 4:00 pm PT on the next month’s Evaluation Day (the fourth business day prior to the end of the month). After that, you'll earn the base tier rate of 0.40% APY or the upper tier rate of 1.00% APY.

We know that's a little complicated, but the good news is that the difference between the introductory rate and the ongoing upper tier rate is negligible.

CIT Bank Savings Builder Fees and Minimums

Like most high-yield savings accounts from online banks, the CIT Bank Savings Builder doesn't charge a monthly maintenance fee or an account opening fee. The bank does charge some fees, however, including:

- $10 for outgoing wires unless you have a balance of $25,000 or more (then it's free).

- $10 for returned deposit items.

Also, there is a minimum deposit of $100 when you open the account. And like any other savings account, there's a limit of six withdrawals per statement period. That said, the bank doesn't appear to charge a fee for excess withdrawals.

How to Access Your CIT Bank Savings

CIT Bank allows its account holders to access their money via the following methods:

- Free electronic banking transfers (ACH) between your Savings Builder and an account at another bank

- Outgoing wire transfers ($10 fee for accounts with balances under $25,000)

- A mailed check

According to CIT Bank’s website, its Savings Builder accounts have “a limit of six pre-authorized or automatic transfers or withdrawals, electronic banking transfers to other accounts or similar per statement cycle.” With that said, if you make a withdrawal or transfer request by mail or telephone, and then have the money mailed to you as a check, it won’t count toward the limit.

Slickdealer deringer praised the bank’s ACH policy on our forums: “I opened a CIT Bank account a year ago to make an emergency savings account (finally) and have been moving money in and out to help pay for my daughter’s college. Never run into an issue ACHing, except that it takes the full 3-5 business days to move. If you can handle that, then go for it.”

How to Use Your CIT Savings Builder Account

High-yield savings accounts like the Savings Builder from CIT Bank are perfect for most short-term savings goals. It's especially a good option for an emergency fund because a savings account is safe (there's no investment risk like there is with a. brokerage account) and liquid (you can access the money anytime you need it).

You may also choose to use the CIT Savings Builder account to save money for a down payment on a home, a family vacation, dedicated savings for the holidays and more. If you have longer-term goals like saving for your child's college education, you'll want to look at other options that can give you a better return in the long run.

And because the APY is better than CD rates and there are no penalties for withdrawals, you don't have to worry about getting access when you need to.

Pairing the CIT Savings Builder with a CIT eChecking Account

If you're tempted to get the CIT Savings Builder account and keep your checking with your current bank, you may want to think twice about that. Getting a high-yield savings account is nice, but a high-yield checking account is even better.

The CIT eChecking account offers a 0.25% APY if you maintain a balance of $25,000, or 0.10% APY for balances that do not meet the threshold. That may not sound like a lot, but the average rate on an interest checking account in the U.S. is 0.03%, according to the FDIC. So you'll get double the value with CIT's eChecking account.

Another feature that could make the account appealing is $30 per month in ATM fee reimbursements. If you get cash from the ATM often, not many banks will give you more value than this one.

Some other CIT eChecking features include:

- No monthly fees.

- EMV-enabled debit card.

- Compatible with Zelle, Apple Pay and Samsung Pay.

- Unlimited withdrawals and disbursements via the CIT Bank mobile app.

- Overdraft fee of $30.

- International transaction fee of 1%.

The CIT Bank eChecking account pairs well with the bank's Savings Builder because of its high APY compared with traditional banks and even credit unions, many of which don't offer interest checking at all. We wouldn't suggest going for the 0.25% APY, though, if you can get double that by stashing your cash in the savings account instead.

Compare CIT Accounts

CIT Bank Savings Connect Account

- Our Rating 4.5/5 How our ratings work Read the review

- APY4.65%

Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Savings Connect account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 - Intro Bonus N/A

CIT Bank's Savings Connect account is one of our top picks for high-yield savings accounts. Featuring a competitive flat APY on all balances, it can go head-to-head with most of the top savings accounts available. What's more, you don't have to do anything special to earn this high interest rate; many similar accounts (including some offered by CIT) only offer their highest interest rates to customers who complete certain requirements.

If you're looking for a strong APY, you'd do well to consider CIT's other high-yield savings account, the CIT Savings Connect account. This account boasts an APY of 4.65%, which is over four times that of the Savings Builder.

CIT Bank Money Market Account

- Our Rating 4/5 How our ratings work Read the review

- APY1.55%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for the CIT Bank Money Market account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100

CIT Bank's Money Market Account doesn’t offer the highest interest rate out there, but you can open an account with only $100, and there's no ongoing minimum balance requirement. This account also doesn't charge any monthly fees, which helps it stand out from other similar accounts.

In addition to high-yield savings accounts, CIT Bank also offers a money market account, which comes with a slightly higher APY at 1.55%. The money market account requires the same $100 minimum deposit when you open the account, but it's a lot less complicated when it comes to earning interest — you'll get the 1.55% APY regardless of your balance. Also, you don't have to meet certain monthly requirements to keep earning it.

CIT Money Market account also offers more flexibility. For example, you can send money to others via Zelle or PayPal (subject to limits) and write checks using your balance.

But, like the CIT Savings Builder account, there's a six-withdrawal limit, and the money market account does charge a $10 fee for each excess withdrawal. It also charges $25 each time you overdraft your account.

So which one's better? It really depends on how you use it. If you simply want an account where you can park your money and don't plan to take withdrawals very often, the money market account may be a better choice. It can especially be worth it if you can't meet the deposit or balance requirements to get the higher APY on the savings account. You can use CIT Bank online offers to make sure you get the best rates for your new account.

However, it's important to keep the money market account's fees in mind. Even if you get charged just one fee in a year, it could defeat the purpose of the higher interest rate. Read our full review of the CIT Bank Money Market account.

Other Products and Services from CIT Bank

In addition to checking, money market and savings accounts, CIT Bank offers a handful of other products and services for its customers.

CIT Bank Term Certificates of Deposit

- Our Rating 3.5/5 How our ratings work Read the review

- Minimum

Deposit Required$1,000 - 1 Year APY0.30%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 3 Year APY0.40%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 13-Month APY3.50%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

Many banks that offer CDs require customers to commit to lengthy terms of several years or more in order to earn the highest interest rates available. However, with CIT Bank's term CDs, the opposite is true. To get the best rates at CIT, you'll need to open one of its shorter-term CDs, such as its 13-month CD that pays 3.50% APY. If you want an easy way to save more money without having to wait years, CIT Bank's term CDs are a solid option.

The bank offers a variety of CDs ranging from six months to five years, including no-penalty CDs with a term of 11 months and no fee if you withdraw early.

CIT Bank No-Penalty Certificate of Deposit

- Our Rating 4.5/5 How our ratings work Read the review

- Minimum

Deposit Required$1,000 - 11-Month APY3.50%

Annual Percentage Yield is accurate as of April 2, 2024. Interest rates for CIT Bank's No-Penalty CD are variable and subject to change at any time without notice.

CIT Bank's No-Penalty CD offers one of the most competitive rates with no early withdrawal penalty on the market. With this account, you can earn a 3.50% APY, and the CD matures in just 11 months, which is shorter than average.

College Savings

On the lending side, CIT Bank offers home purchase and refinance loans.

Mortgage Lending and Refinancing

You can also open a Uniform Transfers to Minors Act account, which is one way to set aside money for a child's college education.

Unfortunately, that's all you'll get, though. Unlike many other banks and credit unions, CIT Bank doesn't provide other forms of loans, such as personal, auto or home equity loans. It also doesn't offer credit cards or investment accounts.

So if you're looking for a bank where you can do all of your financial management under one roof, you'll want to look elsewhere. But if you just need a savings account or savings and checking, CIT Bank is an excellent choice.

What if You Already Have a CIT Bank Account?

If you already have an account with CIT Bank, you can still take advantage of this offer. While you will have to open a new account, the process is quick and relatively simple.

Slickdealer nuffstylez noted that they, “called up today to see if I could switch my account from a High Yield Savings to a Savings Builder, but they said I had to open a new account and either close out the High Yield or keep it also. The nice gentleman on the phone walked me through all the steps doing it online on my computer, took less than five minutes total. I was able to move the funds to the new account, and he closed the other one for me.”

Bottom Line

CIT Bank doesn't offer the top APY out there, but it's important to note that deposit rates are changing constantly. So while you may get a better rate somewhere else, that doesn't mean that bank or credit union will always have the best rate. As such, it's important to consider all of an account's features, as well as other products and services the account offers, to make a decision.

Ready to open a CIT Bank Savings Builder Account? Start here

Also, while you may find similar or even better interest rates at other banks, our community strongly recommends reading the fine print. This is especially relevant when it comes to the rules surrounding withdraws and transfers.

Finally, you may want to consider whether it's worth it to move some or all of your banking away from your current bank. Some financial institutions offer relationship bonuses and benefits to customers who maintain a certain balance, and you may lose access to those if you transfer most of your money to another bank.