Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

2020. Just the mention of these four digits will likely cause people to cringe for decades to come. While 2020 has taken its toll, Americans are looking at 2021 and the new year for a fresh start in one particular area — their finances.

Our latest survey, conducted by OnePoll, reveals how 2020 affected Americans’ financial status, and how they look to improve their situation in 2021.

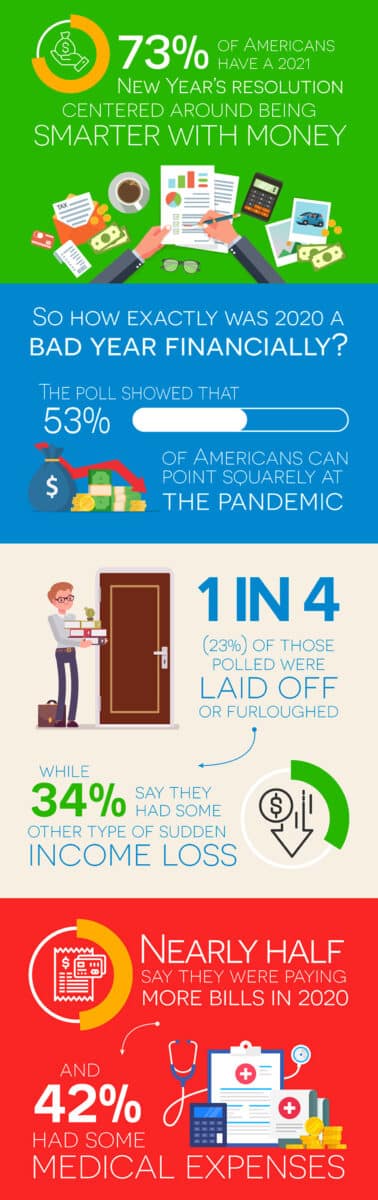

The Harsh Financial Reality of 2020

We saw what seemed to be an endless supply of challenges arrive in 2020. Many Americans faced setbacks specifically in the area of finances. Our survey of 2,005 Americans found that 47% of respondents say that 2020 was a difficult year for them financially.

For 53% of Americans, the cause of financial troubles rests solely on one reason — the COVID-19 pandemic.

Like many individuals in the U.S., survey respondents experienced job loss, drops in income and increased spending because of the pandemic and its effect on the economy and everyday life.

Here’s a look at the reasons for Americans' financial struggles in 2020, based on the survey:

Top 4 Reasons for Financial Struggles in 2020

- Increased bills 49%

- Medical expenses 42%

- Income loss 34%

- Job loss (laid off or furloughed) 23%

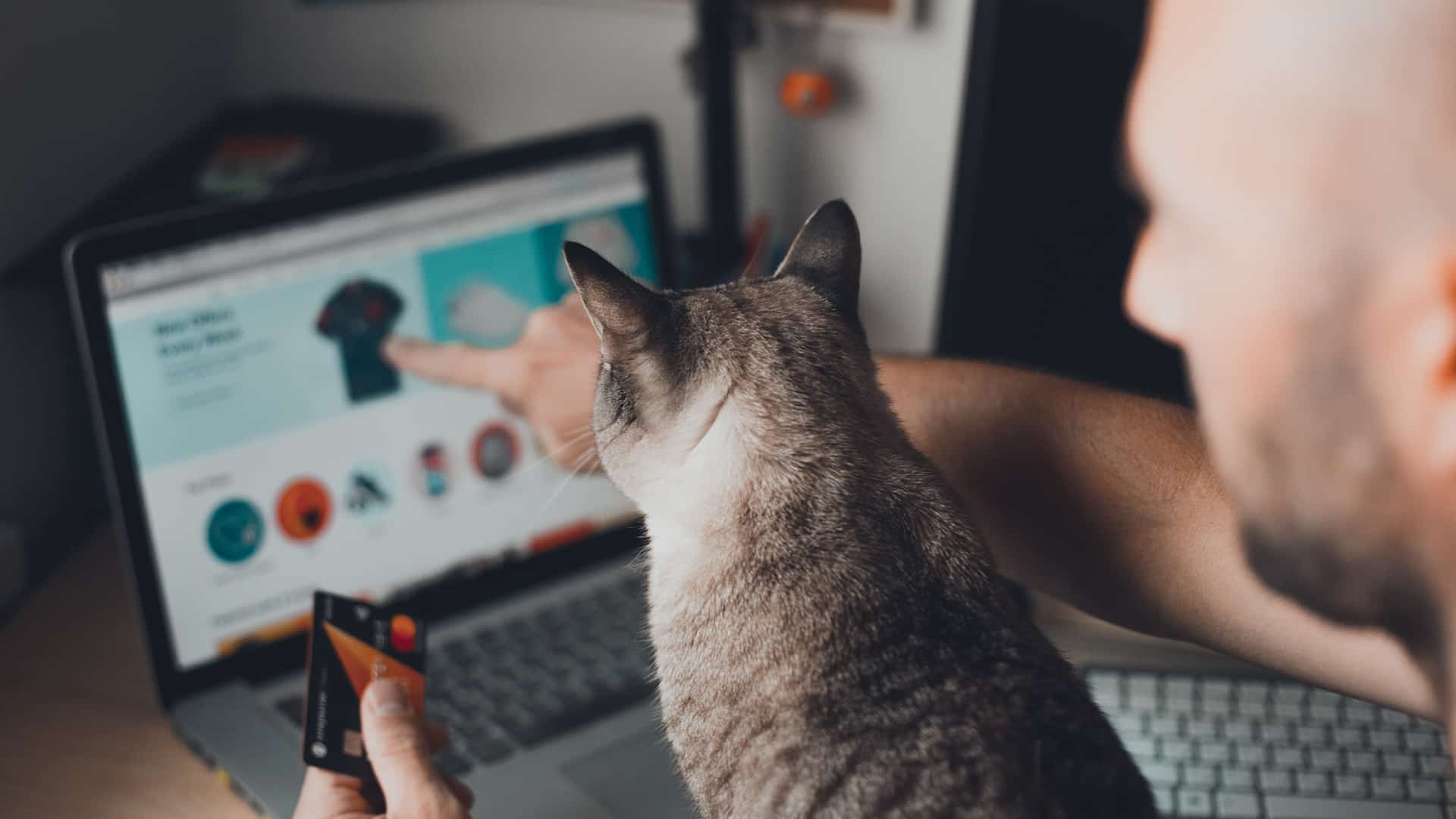

Another factor not to be overlooked is the reality of spending habits during lockdowns. With businesses shut down, schools closed and sports and other activities paused long term, people were left with an abundance of time at home with families. Over half of respondents (59%) said they went overboard on spending due to the sheer amount of boredom the lockdown brought them.

However, the survey results don’t account for spending to help Americans preserve their mental health and decrease stress levels during by the pandemic.

Popular Money Moves to Make in 2021

Recent news of approved vaccines rolling out isn’t the only reason to be hopeful for the upcoming year. With the entrance of a new year, Americans are determined to overcome financial challenges in 2020 by building a better financial future for themselves and their families.

For 73% of Americans, their New Year’s resolutions revolve around being smarter with money. Respondents already have some solid plans lined up for 2021 that will help ease their financial burden a bit.

“A new year provides a clean slate for people to assess their financial situation and make the modifications needed to put them on track,” said Ryan Tronier, Senior Personal Finance Editor for Slickdeals. “Simple changes such as cutting unnecessary subscriptions or looking for more deals and discounts when shopping can quickly add up to big savings.”

Top 5 Ways Americans Plan on Overhauling Their Finances in 2021

- Getting out of debt 38%

- Removing unnecessary bills 33%

- Seek out more deals/coupons 33%

- Spending money more wisely 33%

- Using a savings app 30%

Americans also plan on saving more in the new year. The average respondent said they want to put $327 away per month, with 22% putting away $500 or more.

Tronier added, “At Slickdeals, we believe that every shopping experience can be a winning one for your wallet. Our community of savvy shoppers helps one another discover the best products at the best prices. Over the past twenty one years, our users have saved more than $6.8 billion. By tapping into the knowledge and insights from our unique community, consumers can quickly make strides toward their new year’s financial goals.”