Where savvy shoppers discover and share great deals

- Score The Best Products For The Best Prices

- Sourced by Real People

- Most Trusted Deal Sharing Platform

There’s savvy in every shopper

Why Slickdeals?

Amazing Deals

A dad shopping for toilet paper caught a rare price mistake on a top retail site, scoring a $6,100 TV for $150. That’s winning!

Trusted Insights

A retired U.S. Navy electrician discovered a deal on the “indestructible” electrical wires he used on F-18’s. Excited, he shared his expertise, giving everyone the confidence to buy.

Product Discovery

Every pet lover dreads dealing with pet hair. That’s why, when a vacuum deal started trending, the deal exploded with comments on which models work better for pets, so everyone shopping benefitted!

At Slickdeals

People make great deals possible, not just algorithms

Every Deal is Sourced and Shared by Real People

Our one of a kind online community and team of skilled editors are obsessed with uncovering great products and every layer of savings. Users share, confirm, and comment on deals so that everyone benefits.

Find the Best Products For the Best Prices

Everyone loves to discover a deal that (almost) no one else knows about. Finding an 80% discount or scoring a luxury trip for a rock bottom price is thrilling. With the community’s votes and commentary you’ll have more confidence in your purchase. That’s winning.

Become a Better Shopper Every Time You Search

Whether you’re window shopping or looking for something specific, you’ll gather intel on the things you need and discover new product you’ll love. Along the way, you’ll receive invaluable wisdom on how to shop smarter and save more.

How It Works

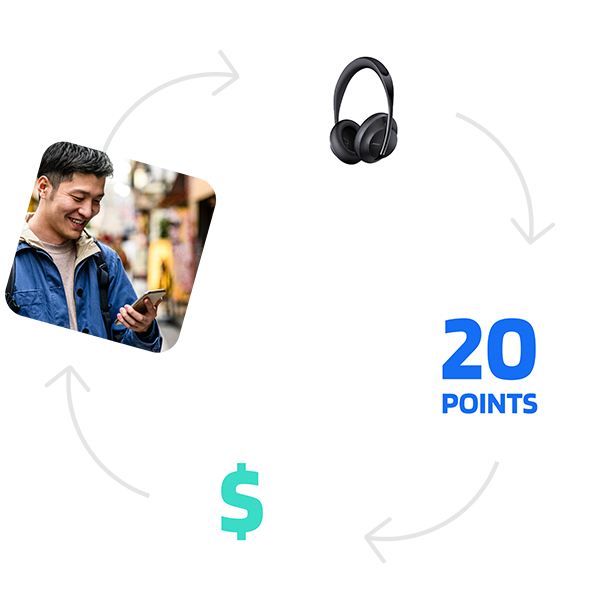

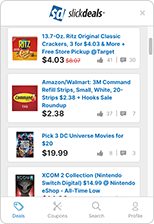

Discover

Explore deals to uncover the community’s favorite products and prices. Search for things you need and stumble upon new items you’ll love.

Engage

Members find, share, vote, and comment on the best deals online every day. Engage with the community by following users, using the Q&A feature to ask fellow users any question, vote on deals, and react with your favorite emojis.

Save

Discover the thrill of the deal by combining discounted prices with the credit card offers, points, and coupons shared by others. At the end of the day, find the best prices for the best products, every time you shop.

We're

Be a part of a collaborative team of passionate people

Our Actions Speak Louder than Our Words.

12 Million Monthly Shoppers

$10 Billion Saved

24 Years Of Slickdealing

View Advertising Opportunities View Our Latest Press

If you’d like to write a story about Slickdeals or for general media inquiries, please contact us at [email protected].

Make the Most of Slickdeals

Browser Extension

Take all the things you love about Slickdeals with you while you shop on other sites. The people, the savings, the insights. Download the extension.

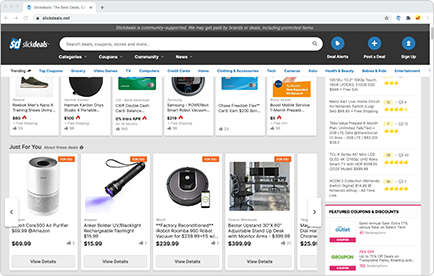

Website

Slickdeals is a roadmap that helps shoppers win. Unlock savings hacks, product reviews and more to help you make better purchases; and learn from the pros on our YouTube channel.