Shipping & Handling Included

Shipments of this item will not be delivered if the recipient of record is not present and available to sign Item may be available in your local warehouse, prices may vary.

Features:

24kt Gold

Item is Non-Refundable

Limit of 1 Transaction Per Membership, with a Maximum of 5 Units

Item is Not Eligible for Price Adjustments

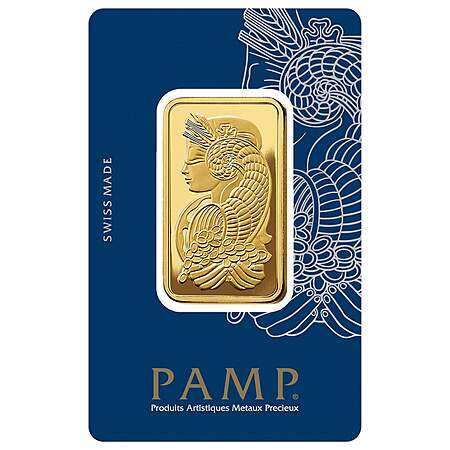

Bar Highlights:

1oz 999.9 fine gold minted bar with a proof-like finish

Swiss-made by a LBMA Good Delivery Refiner

VERISCAN™ Bullion Identification Security System & iPhone® App

Carbon Neutral certified by the Carbon Trust in accordance with the international PAS 2060 Carbon Neutrality Standard, identified by a 'footprint' label

Each bar is individually controlled, registered, and secured within protective CertiPAMP™ packaging with an official Assay Certificate and a digital certificate accessed with a QR Code. Each assay card is covered with a thin removable protective film

https://www.costco.com/.product.4...Yqlg%3D%3D

Leave a Comment

36 Comments

Sign up for a Slickdeals account to remove this ad.

https://www.jmbullion.c

With 4% executive and credit card cash back, it costs $2448.

So, transaction cost is nearly zero. Good, but some of these Costco deals have negative transaction cost.

Compare that to an ETF, where transaction cost is usually zero, but holding cost is about 1% of your investment every 4-5 years due to ETF management fees.

Also be aware Costco executive cash back has a limit of $1,250/year, and many cc cb deals also have limits.

Sign up for a Slickdeals account to remove this ad.

I'll probably hold my stake for at least another decade.

So, the actual spot price doesn't matter much to me - it's basically a wash sale.

If you have to

Sign up for a Slickdeals account to remove this ad.

You can sell to an online outfit like kitco or jm bullion, or you can try a local coin shop/trader. You should shop around - selling physical gold is more like selling a used car than selling stocks. Different buyers will pay different prices. Pawn shops, jewelers, and cash for gold places will also buy gold, but usually won't pay top dollar for it.

Legally, investment bullion is usually a capital gain, short or long term, like stocks. Keep your receipts to prove your cost basis, since a broker isn't doing it for you.

One illegal advantage to physical gold is that the buyer doesn't have to file a 1099 with the IRS unless you sell them over $10k worth. That means you can probably get away with not reporting the gain.

Not tax or legal advice. Talk to a tax professional.

Leave a Comment