Note: This popular deal is still available.

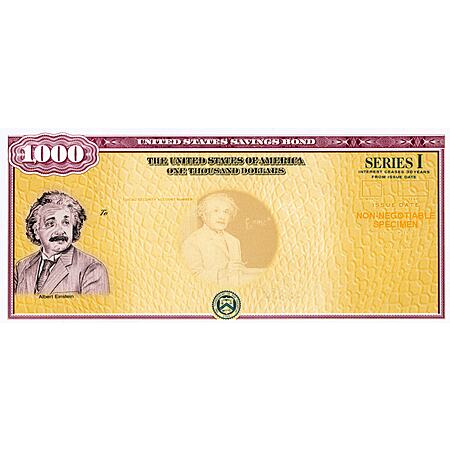

U.S, Government Treasury is currently offering

7.12% Interest Rate in combined

Fixed + Inflation Rate Earnings valid on newly issued

Series I Savings Bonds purchased from November 2021 through April 2022. Limit of $10,000 / year in interest earnings per person.

Thanks to community member

dn90003 for sharing this offer.

About this offer:- How do I buy a Series I bond?

- Must register or sign-in to your free TreasuryDirect.gov account and link a bank account.

- Click here to view a Guided Tour

- What is a Series I bond? (source)

- "A savings bond that earns interest based on combining a fixed rate and an inflation rate."

- You may use Series I bonds to:

- Save in a low-risk product that helps protect your savings from inflation

- Supplement your retirement income

- Give as a gift

- Pay for education

- Click here for more information about Series I Bonds

- What interest does a Series I bond earn? (source)

- A combination of a fixed rate that stays the same for the life of the bond and an inflation rate that is set twice a year.

- For bonds issued from November 2021 through April 2022, the combined rate is 7.12%

Leave a Comment

Top Comments

In case you're wondering, here's how the rate is computed:

Composite rate =

I bought $10k in denominations of 2,3, 5 so if I want to cash out I can do it in chunks instead of having to cash out $10k.: Better than any CD or bank rate if you want to stay in cash.

https://www.treasurydir

3,498 Comments

Sign up for a Slickdeals account to remove this ad.

Can I do the same with my wife and each of my two boths for $40k total? Is the $10k limit per individual? Seems like it but would like to see if anyone knows for sure.

EDIT: Someone posted a link to the answer, which I'll just paste below for anyone else.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you're allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids' names. See Buy I Bonds in Your Kid's Name.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they also buy in their kids' names.

$10,000 in Person A's personal account with Person B as the second owner

$10,000 in Person B's personal account with Person A as the second owner

$10,000 in an account for Person A's trust

$10,000 in an account for Person B's trust

$10,000 in an account for Person A's business

$10,000 in an account for Person B's business

$5,000 using money from their tax refund

$10,000 in the name of each of their kids under 18

But you can wait to transfer it, don't know what your thought process is with such an incomplete question.

Can anyone clarify this? It has been asked a couple of times during the exchanges with no clear outcome...

Sign up for a Slickdeals account to remove this ad.

Can anyone clarify this? It has been asked a couple of times during the exchanges with no clear outcome...

Sign up for a Slickdeals account to remove this ad.

IRS Direct Pay

If you don't pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year's taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don't need to fill out another form.

You get extra time with an extension but you don't have to use it. You can still file your tax return on time before April 15. Choose "Extension" as the reason for payment. Select "4868" in the "Apply Payment To" field, and choose the previous year for the tax period for payment.

Leave a Comment