1: Free Tax USA

https://www.freetaxusa.

2: Credit Karma Tax/Cash App Taxes

https://www.creditkarma

To get two states without paying for the second download:

-Download the program on two computers. Take note where the program is being downloaded (should show you when it gives you the option of where to save). Go through all the updates and then download a different state on each computer.

-Go into your C: drive to where the program was saved and go to the state folder. On my computer it is:

This PC, C:, program files (x86), HRBlock2021, Program, State

-You should see the state folder (NJ, CT, NY). Copy the entire folder on a USB drive and transfer it to the State folder on the other computer. You should now have two state folders in the State folder.

-Both states will now be available to file in the program.

Careful on what version you buy!!!

The below only applies to the Download and Retail versions (both the "Digital Download" and the "Key Card" are the same version and both must be downloaded, the only difference is the delivery method of the product key). The Block Online packages of the same name have limited forms compared to the download version.

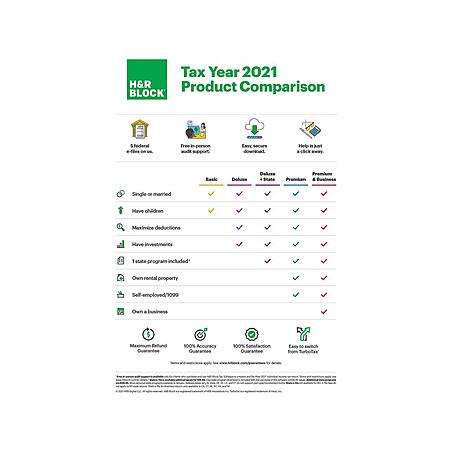

There is much confusion about versions as to what does what and I thought I'd post this to try to clear things up. Many believe that you need Premium or better if you are self employed or have rental income. That is not true. Self employment income and even LLCs along with rental income can be done with Deluxe or Basic. If you get to, corporations, Scorps and Partnerships you will need higher versions

Block likes to upsell you on the versions and there are almost outright deceptive marketing, wording and charts that cause much confusion about what version does what. Deluxe or even Basic will do the vast majority of returns even quite complicated ones.

Many mistakenly believe based on the charts and wording that Block puts out that you need Premium for things such as Schedule C, D & E. Deluxe handles all those forms but if you go by a chart or version picker on Block's site you will be guided to the higher version.

Here is the full list of supported forms for Deluxe Download version

You will see it is a quite extensive list and it will handle the vast majority of returns of your average taxpayers. The bolded text is just showing the most common forms but everything on the list is supported

|

Quote

:

Form 1040 and Schedules 1-3: US Individual Income TaxBackground Worksheet: Background Information Worksheet Dependents Worksheet: Worksheet for Dependents Dependents Att Worksheet: Dependents Attachment Worksheet Child Tax Credit Worksheet: Child Tax Credit Worksheet W-2 Worksheet: Wage and Tax Statement Non-W2 Wages: Worksheet for Wages Not on a W-2 IRA Contributions: IRA Contribution Worksheet Keogh/SEP/SIMPLE Contributions: Keogh/SEP/SIMPLE and Other Contributions Form 1098-E: Student Loan Interest Form 1099-G: Certain Government Payments 1099-R Worksheet: Distributions from Pensions, etc. Social Security Worksheet: Worksheet for Social Security Income 1099-MISC Worksheet: Miscellaneous Income 1099-K Worksheet: Payment Card Network Transactions Attachments Worksheet: Form 1040 Attachments Worksheet Last Year's Data Worksheet: Last Year's Data Worksheet W-2G Worksheet: Statement of Gambling Income Incentive Stock Option Worksheet: Incentive Stock Option Worksheet Self-Employed Health Insurance: Self-Employed Health Insurance Self-Employed Health Iterative: Self-Employed Health Iterative Self-Employed Health Refigure: Self-Employed Health Refigure Foreign Wages Not on a W-2: Foreign Wages Not on a W-2 Schedule 8812: Additional Child Tax Credit Schedule A: Itemized Deductions Home Mortgage Interest Worksheet: Home Mortgage Interest Worksheet Charitable Worksheet: Charitable Donations Worksheet Noncash or Item Donations: Noncash or Item Donations State and Local Income Tax: State and Local Income Tax Payments Worksheet Schedule B: Interest and Dividends Interest Summary: Interest Income Summary Form 1099-INT/OID: Interest Income Worksheet Dividend Summary: Dividend Income Summary Form 1099-DIV: Dividends and Distributions Form 8938: Statement of Specified Financial Assets Schedule C: Profit or Loss from Business Schedule D: Capital Gains and Losses Form 1099-B Account: Form 1099-B Account Capital Gains and Losses Worksheet: Capital Gains and Losses Sale of Home Worksheet: Sale of Home Worksheet Form 8949: Dispositions of Capital Assets Schedule E: Rents, Royalties, Partnerships, Etc. Schedule E Part I Attachment: Schedule E Part I Attachment Schedule E Part II Attachment: Schedule E Part II Attachment Schedule E Part III Attachment: Schedule E Part III Attachment Rentals and Royalties: Rentals and Royalties Worksheet K-1 Partnership/S Corporation: K-1 (Partnership/S Corporation) Worksheet K-1 Estate/Trust: K-1 (Estate/Trust) Worksheet Schedule EIC: Earned Income Credit Schedule F: Profit or Loss from Farming Schedule H: Household Employment Taxes Schedule J: Income Averaging for Farmers & Fishermen Schedule R: Credit for Elderly or Disabled Elderly/Disabled Credit: Worksheet for Elderly or Disabled Credit Schedule SE: Self-Employment Tax Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness Form 1116: Computation of Foreign Tax Credit Form 1116 (AMT): Foreign Tax Credit for AMT Form 1310: Refund Due a Deceased Taxpayer Form 2106: Employee Business Expenses Form 2120: Multiple Support Declaration Form 2210: Underpayment Penalty Form 2210, Schedule AI: Underpayment of Estimated Tax--Sch. AI Form 2439: Undistributed Long-Term Capital Gains Form 2441: Child and Dependent Care Credit Child/Dependent Care: Child/Dependent Care Worksheet Form W-10: Dependent Care Provider Form 2555: Foreign Earned Income Form 3468: Investment Credit Form 3800: General Business Credit Form 3903: Moving Expenses Form 4137: Social Security Tax on Unreported Tips Form 4562: Depreciation and Amortization Depreciation Summary: Summary of Assets Depreciation Worksheet: Depreciation Worksheet Vehicle Worksheet: Vehicle Expense Worksheet Bonus Depreciation Election Out: Bonus Depreciation Election Out Form 4684: Casualties and Thefts Form 4797: Sales of Business Property Form 4835: Farm Rental Income and Expenses Form 4868: Automatic Extension of Time to File Form 4952: Investment Interest Expense Form 4972: Tax on Lump-Sum Distributions Form 5329: Return for IRA and Retirement Plan Tax Form 5405: Repayment of First-Time Homebuyer Credit Form 5695: Residential Energy Credits Form 6198: At Risk Limitations Form 6251: Alternative Minimum Tax Form 6252: Installment Sale Income Form 6781: Section 1256 Contracts Form 8283: Noncash Charitable Contributions Form 8332: Release of Claim to Exemption Form 8379: Injured Spouse Allocation Form 8396: Mortgage Interest Credit Form 8453: US Individual Transmittal for On-Line Filing Form 8582 - Page 1: Passive Activity Loss Limitations Form 8582 Page 2 (Regular Tax): Passive Activity Loss Limitations Form 8582 Page 3 (Regular Tax): Passive Activity Loss Limitations Form 8582 Page 2 (AMT): Passive Activity Loss Limitations Form 8582 Page 3 (AMT): Passive Activity Loss Limitations Form 8586: Low-Income Housing Credit Form 8606: Nondeductible IRAs 8606 Worksheet: Form 8606 Worksheet Returned IRA Contributions: Returned IRA Contributions Form 8609-A: Annual Statement for Low-Income Housing Credit Form 8615: Child With Unearned Income Form 8801: Credit for Prior Year Minimum Tax Form 8814: Parents' Election for Child's Income Form 8815: Exclusion of Interest from Savings Bonds Form 8818: Redemption of EE and I US Savings Bonds Form 8822: Change of Address Form 8822-B: Change of Address - Business Form 8824: Like-Kind Exchanges Form 8829: Expenses for Business Use of Your Home Form 8839: Qualified Adoption Expenses Form 8853: MSA Deduction Form 8859: District of Columbia First-Time Homebuyer Credit Form 8862: Information to Claim Certain Credits Form 8863: Education Credits Tuition Payments: Tuition Payments Worksheet Form 8880: Credit for Qualified Retirement Savings Contributions Form 8885: Health Coverage Tax Credit Form 8888: Allocation of Refund (Including Savings Bond Purchases) Form 8889: Health Savings Accounts (HSAs) Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit Form 8958: Allocation of Tax Amounts in Community Property States Form 8959: Additional Medicare Tax Form 8960: Net Investment Income Tax Form 8962: Premium Tax Credit Form 8962 Information: Form 8962 Information Form 1095-A: Health Insurance Marketplace Statement Form 8962 Part IV Attachment: Form 8962 Part IV Attachment Form 8995: Qualified Business Income Deduction Simplified Computation Form 8995-A Summary: Qualified Business Income Summary Form 8995-A: Qualified Business Income Deduction Form 8995-A Schedule A: Specified Services Trade or Business Form 8995-A Schedule C: Loss Netting and Carryforward Form 8995-A Schedule D: Special Rules for Patrons of Cooperatives QBI Statement: Qualified Business Income Statement Form 9465: Installment Payments of Tax Form 1040-SR and Schedules 1 - 3: US Tax Return for Seniors Form 1040-V: Payment Voucher Form 1040X: Amended U.S. Individual Income Tax Return Form 1040-ES: Estimated Tax Form SS-4: Application for Employer Identification Number W-4 Worksheet: Employee's Withholding Allowance Certificate H&R Block Tax Payment Planner: H&R Block Tax Payment Planner Roth Conversions: Roth Conversion Worksheet Roth Contributions: Roth Contribution Worksheet Filing Status Calculator: Married Filing Joint vs. Separate Calculator State Information: State Information Worksheet Other State Tax Credit: Other State Tax Credit Worksheet De Minimis Safe Harbor: De Minimis Safe Harbor Small Taxpayer Safe Harbor: Small Taxpayer Safe Harbor Clergy Worksheet 1: Clergy Worksheet 1 Clergy Worksheet 2: Clergy Worksheet 2 Clergy Worksheet 3: Clergy Worksheet 3 Clergy 2106 Expense Statement: Clergy Worksheet for SE Tax Employee Business Expenses |

Leave a Comment

81 Comments

Sign up for a Slickdeals account to remove this ad.

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank texasPI

With that said, does FL tax need to be filed? I'm split between NYC and FL, wonder if I need to do some sort of filing for FL or if I just file NY as part year resident and ignore FL

With that said, does FL tax need to be filed? I'm split between NYC and FL, wonder if I need to do some sort of filing for FL or if I just file NY as part year resident and ignore FL

With that said, does FL tax need to be filed? I'm split between NYC and FL, wonder if I need to do some sort of filing for FL or if I just file NY as part year resident and ignore FL

In your FL case, you don't even have to bother with filing FL state tax (or printing), but you will have to file for the "tax & spend" socialist NY state you luckily escaped from.

With that said, does FL tax need to be filed? I'm split between NYC and FL, wonder if I need to do some sort of filing for FL or if I just file NY as part year resident and ignore FL

Sign up for a Slickdeals account to remove this ad.

Leave a Comment