- MySavingsDirect (Emigrant Bank) [mysavingsdirect.com] - 4.35%

- Merchants Bank of Indiana [merchantsbankofindiana.com] - 4.34%

- Bask Bank [baskbank.com] - 4.25%

- UFB Direct [ufbdirect.com] - 4.21%

- Upgrade Premier [upgrade.com] - 4.13%

- Salem Five Direct [salemfivedirect.com] - 4.10%

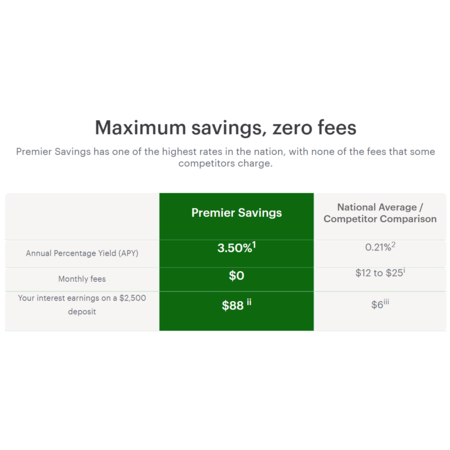

- Capital One 360 Savings [capitalone.com] - 3.4%

- Robinhood Gold [robinhood.com] - 3.75% w/ $5/mo membership (Can't verify)

This post can be edited by most users to provide up-to-date information about developments of this thread based on user responses, and user findings. Feel free to add, change or remove information shown here as it becomes available. This includes new coupons, rebates, ideas, thread summary, and similar items.

Leave a Comment

Top Comments

The point I'm making is, if the Fed meets expectations (currently 50bps-50bps-25bps-pause) over the next 4 meetings, the rates will theoretically stay where they are.

To use a real-world example, it's the same reason why mortgage rates have been rising gradually and why they didn't suddenly rise 75bps yesterday or today upon the Fed hike announcement. It's because it was already priced in.

Edit: Note, I'm leaving quite a bit of nuance and detail out of this and am not picking on you in particular. I just see quite a bit of misunderstanding about how consumer interest rate products react to Fed overnight rate hikes and when.

Source: Work in finance

351 Comments

Sign up for a Slickdeals account to remove this ad.

They keep changing the savings acct name, so you have to call them to get the increased rate, if you have the 3.16% account or lower! You can do it on the Savings acct you don't need the Money Market acct.

They keep changing the savings acct name, so you have to call them to get the increased rate, if you have the 3.16% account or lower! You can do it on the Savings acct you don't need the Money Market acct.

Right now I am in Ally at 2.75. An online calculator tells me that with a deposit of $100k into Capital One (3 prcnt plus $1k bonus), I come out slightly ahead versus putting that $100k into UFB.

Right now I am in Ally at 2.75. An online calculator tells me that with a deposit of $100k into Capital One (3 prcnt plus $1k bonus), I come out slightly ahead versus putting that $100k into UFB.

If you don't mind moving your money around and really want to maximize your value, optimal move would be park the $100K balance in Capital One for 3 months until you've earned the $1k signup bonus, then move it all to UFB.

Sign up for a Slickdeals account to remove this ad.

If you don't mind moving your money around and really want to maximize your value, optimal move would be park the $100K balance in Capital One for 3 months until you've earned the $1k signup bonus, then move it all to UFB.

There are countless reddit threads across various subs asking whether they should lock in a mortgage rate the day before the FOMC thinking they'll get a mortgage rate the exact bps lower than the Fed is hiking. And those posts aren't universally corrected. It's a real issue in financial literacy and this extends to savings accounts.

It does change what you said because what you stated was partially incorrect. As I had already prognosticated, my online savings account rate went up 0.50%. This is now about a week after the Fed raised rates. The bond market is an entirely separate entity. It is actively traded by traders. Everything the Fed does influences it (they have three tools: raising/reducing the reserve requirement, buying/selling bonds, and raising/lowering interest rates). But when it comes to deposit rates, the only thing that it affects is the rate you get on your deposits. They have a reserve requirement they need to meet weekly (reserve requirement set by Fed), and when they don't meet it, they need to borrow from other banks on the "overnight" rate to meet it. It is easier to get loose when that rate is virtually nothing, but as it gets higher, it isn't so easy. So, if the Fed is at a target rate of 4%, they're better off advertising a deposit rate of 3.5% to attract your money rather than paying the overnight rate to member banks.

Hence, when the Fed raises rates, it directly influences deposit rates to you. I was at 3% APR when I made my original statement, and now I am at 3.5% a little over a week later.

And mortgage rates are dictated by the 10-year yield bond market. Those bonds are influenced by perception in monetary policy (tightening influences higher rates, loosening influences lower rates). Again, those rates ultimately move on multiple perceptions of various tools of monetary policy (bond buying/selling, interest rate increases/decreases). They are two totally separate things (deposit account rates and mortgage rates).

If you don't mind moving your money around and really want to maximize your value, optimal move would be park the $100K balance in Capital One for 3 months until you've earned the $1k signup bonus, then move it all to UFB.

Capital One T&C says:

Certain deposit transactions initiated through the Capital One website to retrieve funds from your external account are subject to limits. If you are subject to these limits, in order to meet the offer requirements, you would need to initiate the deposit by another external method, such as mobile deposit or setting the initial deposit to send (rather than be retrieved from) from your external financial institution.

Can anyone with a Capital One accnt comment on what the limits are? I would be transferring from Ally.

That's a stellar rate though.

have you done business with this bank?

any pros/cons worth mentioning?

Thanks for the share

That's a stellar rate though.

have you done business with this bank?

any pros/cons worth mentioning?

Thanks for the share

It also appears Brilliant bank doesn't offer savings accnts in all states, mine of course being one of them it seems.

It also appears Brilliant bank doesn't offer savings accnts in all states, mine of course being one of them it seems.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment