1: Free Tax USA

https://www.freetaxusa.

2: IRS Free File: Do your Taxes for Free (for AGI $73,000 or less)

https://www.irs.gov/filing/free-f...s-for-free

3: Cash App Taxes (Formally Credit Karma Tax)

https://cash.app/taxes

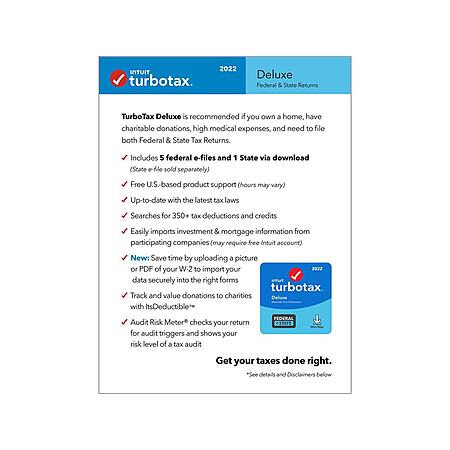

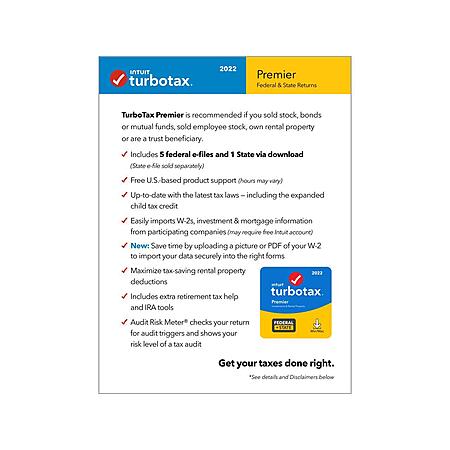

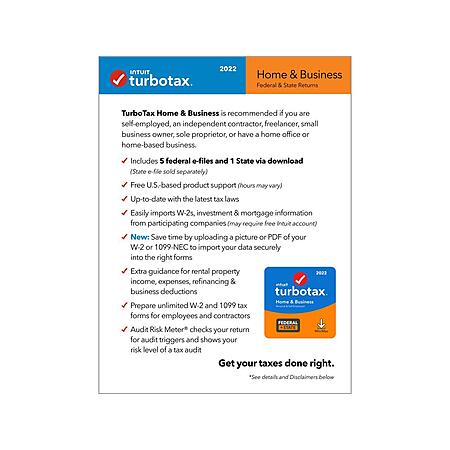

Deluxe Desktop version handles stocks, crypto (Where does it say it covers crypto, cant find it in version comparison!!!), IRA/ROTH, interest income etc and imports the 1099 information from your brokerage account. You dont need Premier Desktop version to do it (the online versions are different). Deluxe includes the step by step walk through as well

Version Comparison:

https://turbotax.intuit

Leave a Comment

Top Comments

If you expect any sizable state refund, e-file is probably worth it to avoid the delay in paper return processing.

For the people asking if the online version goes on sale. I don't ever remember it ever being on sale, but Robinhood gave $10 off if you used their link with them last year.

That said I can certainly see situations where the preparer/CPA might notice more deductions/credits you can take, although I will say Intuit does a lot of handholding, asking questions about stuff you've done in the year, and that's all geared toward saving you $$.

A few years ago, back when I first got out of college, I filled out TT for us (at the time no kids) and it came up with that I owed a bunch of $$ which was odd. So I filled out HR and TA as well, just for multiple sources (each will give you a refund/owe figure without paying for it), and HR actually came out more $$ than the other 2. Turned out that HR was incorrectly applying a penalty fee for whatever reason (basically if your income jumps year over year they don't penalize you for underpayment, or at least that's how it used to be).

135 Comments

Sign up for a Slickdeals account to remove this ad.

1. W2

2. Home

3. Stocks and Bonds?

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank Dr. J

Until I went to a highly recommended CPA for $150 even though I only had a 1099, student loans & healthcare tax info. But my federal return difference was more than enough to offset paying a professional.

(Plus this year I'll have some independent contractor stuff I knew I'd have last year, and at some point Crypto that needs to be dealt with, so I wanted to get familiar with this guy early.)

That doesn't make any sense unless he's helping you deduct things you aren't entitled to

You owe what you owe, having a cpa vs tax software won't change that unless there's some significant deduction you aren't aware of, which is uncommon for simple returns

It wasn't some massive difference just a minor bump. Could have also just been some change in federal tax code I didn't know about 🤷

That said I can certainly see situations where the preparer/CPA might notice more deductions/credits you can take, although I will say Intuit does a lot of handholding, asking questions about stuff you've done in the year, and that's all geared toward saving you $$.

A few years ago, back when I first got out of college, I filled out TT for us (at the time no kids) and it came up with that I owed a bunch of $$ which was odd. So I filled out HR and TA as well, just for multiple sources (each will give you a refund/owe figure without paying for it), and HR actually came out more $$ than the other 2. Turned out that HR was incorrectly applying a penalty fee for whatever reason (basically if your income jumps year over year they don't penalize you for underpayment, or at least that's how it used to be).

Sign up for a Slickdeals account to remove this ad.

Leave a Comment