Servicemembers in all branches of the armed forces are eligible for membership. This category includes Active Duty members of the Army, Marine Corps, Navy, Air Force, Coast Guard, National Guard and Space Force, as well as Delayed Entry Program (DEP), DoD Officer Candidate/ROTC, DoD Reservists, Veterans, retirees and annuitants.

Also family members of the above including parents, grandparents, spouses, siblings, children (including adopted and stepchildren), grandchildren, and household members.

Source: https://www.navyfederal

Not explicitly stated above, but the family member need not be a Navy Federal member, and in fact, doesn't have to be still living. For example, if your late grandfather was in the National Guard back in the 50s, you are eligible.

Leave a Comment

Top Comments

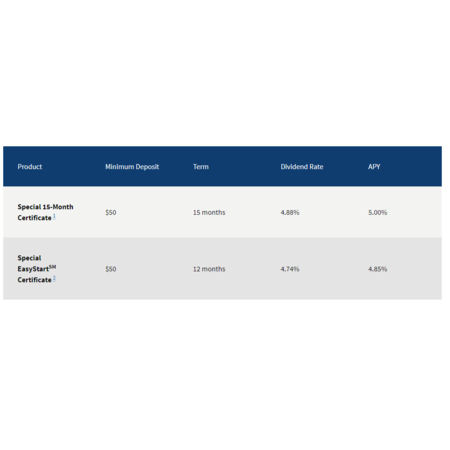

$10,000 gets you $10,644 at maturity.

the sick part, if you click the show details tab.... the effing government is going to take aprox $205 of that in taxes when you file....

258 Comments

Sign up for a Slickdeals account to remove this ad.

That $63 in profit is so small idk if it worth doing so.

Obviously if someone do $10,000 for example then I can see the appeals.

The reason why I said $1000 is because the average American typically saves $400 according to sources. As we head to possible recession, I thought maybe the average American would put more $ in saving. Guess I'm wrong here.

$10,000.00 (for example) * 0.05 = $500.00 in profits at month #15?

Also, if you are barely putting in any money, then iBonds...

It's too bad that the rate is only available for a limited group.

Sign up for a Slickdeals account to remove this ad.

$10,000.00 (for example) * 0.05 = $500.00 in profits at month #15?

$10,000 gets you $10,644 at maturity.

the sick part, if you click the show details tab.... the effing government is going to take aprox $205 of that in taxes when you file....

If Navy Federal borrows $100 from you with the percentage that's posted, how much do you think you'll get?

$10,000 gets you $10,644 at maturity.

the sick part, if you click the show details tab.... the effing government is going to take aprox $205 of that in taxes when you file....

If $439 is what would left on the table to keep then probably not worth it especially if for example he or she constantly put $100 into the savings every paycheck. What do you think?

Sign up for a Slickdeals account to remove this ad.

https://www.treasurydir

Leave a Comment