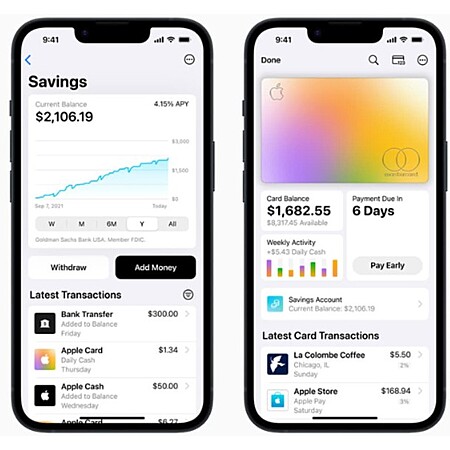

Apple is offering an

Apple Card Savings Account with 4.15% Interest.

Thanks to Community Member

SUCHaDEAL for finding this deal.

- High-yield APY of 4.15%

- No Fees

- No Minimum Deposits

- No Minimum Balance Requirements

- No Foreign Transaction Fees

What you need to open and maintain an account:- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

How to set up Savings:- On your iPhone, open the Wallet app and tap Apple Card.

- Tap the More button, then tap Daily Cash.

- Tap Set Up next to Savings, then follow the onscreen instructions.

- Additional Setup Information

Leave a Comment

Top Comments

https://learn.applecard

https://wallet.apple.co

526 Comments

Sign up for a Slickdeals account to remove this ad.

Interest that you earn is compounded daily and credited to your Savings account monthly.

I have money in both now.

Rates will certainly change in the future, but what's stopping you from moving it back in the future if you wanted to? You don't have to close your Ally account.

The monocle and tophat industry is gonna crater.

Sign up for a Slickdeals account to remove this ad.

One of the most disappointing things about the card is the lack of a sign-up bonus. Very few rewards cards offer no sign-up bonus."

(ThePointsguy/March 2023)

Our community has rated this post as helpful. If you agree, why not thank Karkos

Fidelity is 4.48%

https://www.fidelity.co

Vanguard is 4.77%

https://investor.vangua

Robinhood Gold is 4.4%

https://robinhood.com/us/en/suppo...rest-rate/

Sign up for a Slickdeals account to remove this ad.

My suggestion, open an Apple account, link it to your Ally account for transfers and vice versa. Then you can move money back and forth to play the rates keeping at least the minimum to keep the other account active/open.

Leave a Comment