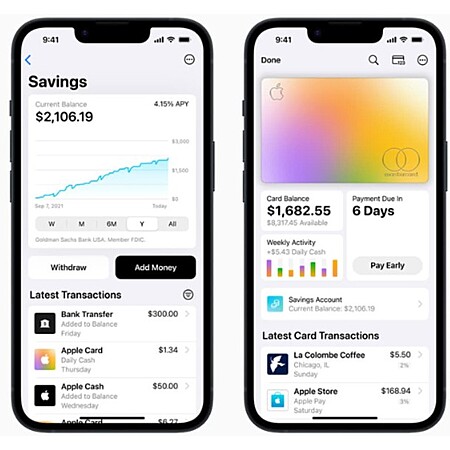

Apple is offering an

Apple Card Savings Account with 4.15% Interest.

Thanks to Community Member

SUCHaDEAL for finding this deal.

- High-yield APY of 4.15%

- No Fees

- No Minimum Deposits

- No Minimum Balance Requirements

- No Foreign Transaction Fees

What you need to open and maintain an account:- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

How to set up Savings:- On your iPhone, open the Wallet app and tap Apple Card.

- Tap the More button, then tap Daily Cash.

- Tap Set Up next to Savings, then follow the onscreen instructions.

- Additional Setup Information

Leave a Comment

Top Comments

https://learn.applecard

https://wallet.apple.co

526 Comments

Sign up for a Slickdeals account to remove this ad.

Where did u see 4.25%?

Where did u see 4.25%?

Fidelity is 4.48%

https://www.fidelity.co

Vanguard is 4.77%

https://investor.vangua

Robinhood Gold is 4.4%

https://robinhood.com/us/en/suppo...rest-rate/

Sign up for a Slickdeals account to remove this ad.

1) their interest is only 4.3% (likely to get lower in the future), extra 0.5% (through refer) only last 3 months to at most 6 months.

2) nobody knows what happens when wealthfront itself goes out of business. all they claim is: we have $2M insurance, but that's for their partner banks. what if wealthfront goes bankruptcy?? you can't contact those partner banks by yourself to get the money, because you don't have a direct account with them. you will be stuck. again, no one has experienced this, so you may or may not get the money. so you'd hope wealthfront doesn't go out of business anytime soon.

If you have more than $250k, there are better investment options. maybe you can sleep better at night.

But, I also recently signed up for a Wealthfront savings account with the bulk of my savings cash and am currently at 4.80% APY and very pleased with the account and abilities so far.

t APY!

Keep in mind there are others like Discover 3.75, Synchrony 4.15 apy, ally 3.75%.

1) their interest is only 4.3% (likely to get lower in the future), extra 0.5% (through refer) only last 3 months to at most 6 months.

2) nobody knows what happens when wealthfront itself goes out of business. all they claim is: we have $2M insurance, but that's for their partner banks. what if wealthfront goes bankruptcy?? you can't contact those partner banks by yourself to get the money, because you don't have a direct account with them. you will be stuck. again, no one has experienced this, so you may or may not get the money. so you'd hope wealthfront doesn't go out of business anytime soon.

If you have more than $250k, there are better investment options. maybe you can sleep better at night.

I'm all-in on apple ecosystem, so it's possible that after my bonus rate expires, I'll just transfer that money to the Apple Card savings account.

Sign up for a Slickdeals account to remove this ad.

"

Boost maximums: There's no limit to the number of referrals you can make, and the maximum total duration of APY increases you can earn across all promotions is 6 months.

"

You'd better hope Wealthfront doesn't go out of business in these 6 months.

I'm all-in on apple ecosystem, so it's possible that after my bonus rate expires, I'll just transfer that money to the Apple Card savings account.

Leave a Comment