Shipping & Handling Included

Shipments of this item will not be delivered if the recipient of record is not present and available to sign Item may be available in your local warehouse, prices may vary.

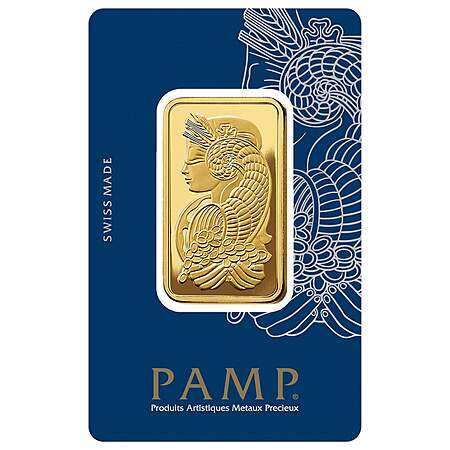

Features:

24kt Gold

Item is Non-Refundable

Limit of 1 Transaction Per Membership, with a Maximum of 5 Units

Item is Not Eligible for Price Adjustments

Bar Highlights:

1oz 999.9 fine gold minted bar with a proof-like finish

Swiss-made by a LBMA Good Delivery Refiner

VERISCAN™ Bullion Identification Security System & iPhone® App

Carbon Neutral certified by the Carbon Trust in accordance with the international PAS 2060 Carbon Neutrality Standard, identified by a 'footprint' label

Each bar is individually controlled, registered, and secured within protective CertiPAMP™ packaging with an official Assay Certificate and a digital certificate accessed with a QR Code. Each assay card is covered with a thin removable protective film

https://www.costco.com/.product.4...Yqlg%3D%3D

Leave a Comment

36 Comments

Sign up for a Slickdeals account to remove this ad.

Just buy GDXU ETF gold stock from broker

It's only $38 per share.

https://www.jmbullion.c

With 4% executive and credit card cash back, it costs $2448.

So, transaction cost is nearly zero. Good, but some of these Costco deals have negative transaction cost.

Compare that to an ETF, where transaction cost is usually zero, but holding cost is about 1% of your investment every 4-5 years due to ETF management fees.

ETF or GTFO. If you think societal collapse is going to happen, buy ammo and booze. They're sure things.

ETF or GTFO. If you think societal collapse is going to happen, buy ammo and booze. They're sure things.

An entire gold depository just poofed up in smoke a few weeks ago. Oxford Gold Group. Headquarters abandoned, nobody around. Some people lost their entire retirement. . Imagine your ETF has an IOU ticket for "gold" stored there? Bernie Madoff got pretty far with a racket like that too. People still haven't been made whole even today. There's a reason some would prefer to hold it physically themselves.

My exposure to gold is gold futures contracts, which have a 60/40 tax advantage, physical gold, and GDX and GDXJ gold miner funds. I do not have physical gold etfs but I understand why some might.

Just buy GDXU ETF gold stock from broker

It's only $38 per share.

An entire gold depository just poofed up in smoke a few weeks ago. Oxford Gold Group. Headquarters abandoned, nobody around. Some people lost their entire retirement. . Imagine your ETF has an IOU ticket for "gold" stored there? Bernie Madoff got pretty far with a racket like that too. People still haven't been made whole even today. There's a reason some would prefer to hold it physically themselves.

My exposure to gold is gold futures contracts, which have a 60/40 tax advantage, physical gold, and GDX and GDXJ gold miner funds. I do not have physical gold etfs but I understand why some might.

I never understood why people think digital gold is less prone to theft than physical. That's certainly not proven.

Brokerage accounts get hacked, ETF management can lie.

The odds of those things aren't high, but neither is some random thief knowing I have gold and finding out where it is.

Of course, if you are an idiot and display the gold where people see it and can find it easily, that seriously increases odds of theft.

- Don't put it in your bedroom drawers, jewelry box, or safe.

- Hide it well.

- Put a note as to where it is with your estate documents (will and medical directives), so the gold isn't lost if something happens to you. Only trusted individuals should know where your estate documents are, but they shouldn't know about the note. If the documents are stolen, move the gold.

Just buy GDXU ETF gold stock from broker

It's only $38 per share.

There's plenty of leverage in gold stocks already so I don't think GDXU is a good idea.

Sign up for a Slickdeals account to remove this ad.

An entire gold depository just poofed up in smoke a few weeks ago. Oxford Gold Group. Headquarters abandoned, nobody around. Some people lost their entire retirement. . Imagine your ETF has an IOU ticket for "gold" stored there? Bernie Madoff got pretty far with a racket like that too. People still haven't been made whole even today. There's a reason some would prefer to hold it physically themselves.

My exposure to gold is gold futures contracts, which have a 60/40 tax advantage, physical gold, and GDX and GDXJ gold miner funds. I do not have physical gold etfs but I understand why some might.

This on isn't at a better price in relation to spot than the others, and I don' t think anyone absolutely loves the Lady Fortuna design.

If you have to

This is just a fad like cryptocurrencies people fall for it and tie up their cash in these schemes never to see it again😆

edit: of course, you will have to buy a gold ball chain. But looks cool, promise!

edit: of course, you will have to buy a gold ball chain. But looks cool, promise!

Lady fortuna will be a wrinkled hag in no time.

Sign up for a Slickdeals account to remove this ad.

Brokerage accounts get hacked, ETF management can lie.

The odds of those things aren't high, but neither is some random thief knowing I have gold and finding out where it is.

Of course, if you are an idiot and display the gold where people see it and can find it easily, that seriously increases odds of theft.

- Don't put it in your bedroom drawers, jewelry box, or safe.

- Hide it well.

- Put a note as to where it is with your estate documents (will and medical directives), so the gold isn't lost if something happens to you. Only trusted individuals should know where your estate documents are, but they shouldn't know about the note. If the documents are stolen, move the gold.

Leave a Comment