Offer Code: 1000PR

Must be Bank of America Preferred Rewards member. Non-members can still get a bonus, but the non-member bonus is capped at $600.00.

If you are not a member, you can become one for this benefit, but you will need to meet the other preferred rewards criteria, most notably having a Bank of America checking account.

Nice part of this bonus. All criteria can easily be accomplished in 120 days, of which only 90 days are required to keep the money with Merrill. Most brokerage deals require you to keep assets with them for 1-2 years.

I have personally got a $200 bonus in the past for my IRA, so they do pay up, and I'm considering sending them my brokerage account under this deal.

Merrill's self-directed brokerage is competitive with their fee structure, offering the usual no transaction fees on most stock/ETF purchases, and generally reasonable fees overall. I have no experience with their advisor offerings, which would cost more money in fees.

https://www.merrilledge.com/offers/1000offer

Excessive Amounts of Fine Print Below. I've bolded the most important bits, but if you do banking/cc/brokerage bonuses, you should learn to read the fine print...

----

* Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more about pricing, visit our Pricing page.

** Other fees may apply. Free and $0 means there is no commission charged for these trades. $0 option trades are subject to a $0.65 per-contract fee. Sales are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs. To learn more about Merrill pricing, visit our Pricing page.

Offer valid for new and existing individual Merrill IRAs or Cash Management Accounts (CMA). Cash bonus offers, in the aggregate, are limited to one CMA and one IRA per accountholder. Eligible Merrill IRAs are limited to Traditional, Roth, and owner-only SEP IRA. The Merrill IRA or CMA may be a Merrill Edge Self-Directed account, Merrill Edge Advisory Account, Merrill Guided Investing account or Merrill Guided Investing with Advisor account. You may be eligible for a different or better offer. Please contact us for more information.

Offer Limitations: This offer does not apply to business/corporate accounts, investment club accounts, partnership accounts and certain fiduciary accounts held with Merrill, UTMA/UGMA accounts, 529 Plan accounts, or to any types of accounts (including IRAs or CMAs) held with other business units of Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S). Merrill reserves the right to change or cancel this offer at any time, without notice. This offer may not be used as an inducement to sell any kind of insurance, including annuities.

How it Works:

You must enroll by entering the offer code in the online application during account opening or by providing it when speaking with a Merrill Financial Solutions Advisor at 888.637.3343 or at select Bank of America® financial centers. You are solely responsible for enrolling or asking to be enrolled in the offer.

Fund your account with at least $20,000 in qualifying net new assets within 45 days of account opening.

Assets transferred from other accounts at MLPF&S, Bank of America Private Bank, or 401(k) accounts administered by MLPF&S do not count towards qualifying net new assets.

You must be enrolled in Preferred Rewards as of 90 days from meeting the funding criteria described in Step 2.

After 90 days from meeting the funding criteria described in Step 2,

your cash reward will be determined by the qualifying net new assets in your account (

irrespective of any losses or gains due to trading or market volatility) as follows:

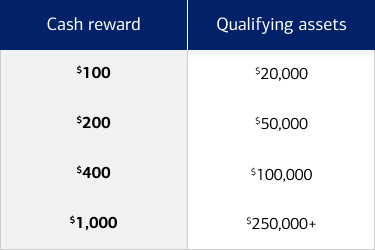

Qualifying Net New Asset Balance Cash Reward

Less than $20,000 $0

$20,000 to $49,999 $100

$50,000 to $99,999 $200

$100,000 to $249,999 $400

$250,000 or more $1,000

For purposes of this offer, qualifying net new assets are calculated by adding total incoming assets or transfers (including cash, securities and/or margin debit balance transfers), and subtracting assets withdrawn or transferred out of the account within the preceding 24 weeks.

Your one-time cash reward

will be credited to your IRA or CMA within two weeks following the end of the 90-day period. If your account is enrolled in an investment advisory program, such as Merrill Edge Advisory Account, Merrill Guided Investing account or Merrill Guided Investing with Advisor account, any cash reward deposited into your account will be subject to the program fee and other terms of the investment advisory program.

Customers not enrolled in Preferred Rewards as of 90 days after funding will receive the following cash reward: qualifying net new assets of $20,000 to $49,999 receive $100; for $50,000-$99,999, receive $150; for $100,000-$249,999, receive $250; for $250,000 or more, receive $600.

Promotional Early Enrollment in Preferred Rewards: When you enroll in the Preferred Rewards $1000 More Cash Offer, you consent to early enrollment in the Preferred Rewards Program.

Once you satisfy the funding requirement for the offer, you will be enrolled in Preferred Rewards within 45 days based on your current balances at that time rather than the usual requirement of three-month average combined balances.

You also must have or open an eligible Bank of America personal checking Advantage Banking account to be enrolled in Preferred Rewards. All Preferred Rewards benefits available in the tier associated with your combined balance level will be active within 30 days of enrollment.

Preferred Rewards Program Eligibility. You can enroll, and maintain your membership, in the Bank of America Preferred Rewards® program if you have an active, eligible personal checking account with Bank of America® and maintain the balance required for one of the balance tiers. The balance tiers are $20,000 for the Gold tier, $50,000 for the Platinum tier, $100,000 for the Platinum Honors tier, $1,000,000 for the Diamond tier and $10,000,000 for the Diamond Honors tier. Balances include your combined, qualifying Bank of America deposit accounts (such as checking, savings, certificate of deposit) and/or your Merrill investment accounts (such as Cash Management Accounts, 529 Plans). You can satisfy the combined balance requirement for enrollment with either:

a three-month combined average daily balance in your qualifying deposit and investment accounts, or

a current combined balance, provided that you enroll at the time you open your first eligible personal checking account and satisfy the balance requirement at the end of at least one day within 30 days of opening that account.

Refer to your Personal Schedule of Fees for details on accounts that qualify towards the combined balance calculation and receive program benefits. Eligibility to enroll is generally available three or more business days after the end of the calendar month in which you satisfy the requirements. Benefits become effective within 30 days of your enrollment, or for new accounts within 30 days of account opening, unless we indicate otherwise. Bank of America Private Bank clients qualify to enroll in the Diamond Tier regardless of balance and may qualify for the Diamond Honors tier based on their qualifying Bank of America, Merrill and Private Bank balances. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on Bank of America employee qualification requirements, please call Employee Financial Services or refer to the Bank of America intranet site. Employees of companies participating in the Bank of America Employee Banking and Investing Program may be eligible to participate on customized terms. Refer to CEBI Program for details.

Learn more about Preferred Rewards.

Tax Disclaimer: The cash reward will be credited as investment earnings to your account.

Merrill may issue an Internal Revenue Service Form 1099 (or other appropriate form) to you that reflects the value of the reward. If the cash reward is credited to your IRA,

the IRS may view the reward as taxable income or as a contribution to the IRA (if it is an excess contribution, it may be subject to an annual 6% excise tax if not timely distributed). Please

consult your tax advisor for more information regarding the proper tax treatment. Bank of America and Merrill do not provide tax, accounting, regulatory or legal advice and are not responsible for any adverse tax consequences (including taxes, penalties and interest) related to the reward.

You have choices about what to do with your employer-sponsored retirement plan accounts. Depending on your financial circumstances, needs and goals, you may choose to roll over to an IRA or convert to a Roth IRA, roll over an employer-sponsored plan from your old job to your new employer, take a distribution, or leave the account where it is. Each choice may offer different investment options and services, fees and expenses, withdrawal options, required minimum distributions, tax treatment (particularly with reference to employer stock), and different types of protection from creditors and legal judgments. These are complex choices and should be considered with care. For more information visit our rollover page or call Merrill at 888.637.3343.

2 The Chief Investment Office (CIO) develops the investment strategies for Merrill Guided Investing and Merrill Guided Investing with Advisor, including providing its recommendations of ETFs, mutual funds and related asset allocations. Managed Account Advisors LLC (MAA), Merrill's affiliate, is the overlay portfolio manager responsible for implementing the Merrill Guided Investing strategies for client accounts, including facilitating the purchase & sale of ETFs and mutual funds in client accounts and updating account asset allocations when the CIO's recommendations change while also implementing any applicable individual client or firm restriction(s).

Footnote

3 Please review the applicable Merrill Guided Investing Program Brochure (PDF) or Merrill Guided Investing with Advisor Program Brochure (PDF) for information including the program fee, rebalancing, and the details of the investment advisory program. Your recommended investment strategy will be based solely on the information you provide to us for this specific investment goal and is separate from any other advisory program offered with us. If there are multiple owners on this account, the information you provide should reflect the views and circumstances of all owners on the account. If you are the fiduciary of this account for the benefit of the account owner or account holder (e.g., trustee for a trust or custodian for an UTMA), please keep in mind that these assets will be invested for the benefit of the account owner or account holder. Merrill Guided Investing is offered with and without an advisor. Merrill, Merrill Lynch, and/or Merrill Edge investment advisory programs are offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S") and Managed Account Advisors LLC ("MAA") an affiliate of MLPF&S. MLPF&S and MAA are registered investment advisers. Investment adviser registration does not imply a certain level of skill or training.

Footnote

4 The Merrill Guided Investing program investment minimum is $1,000 for growth-focused strategies and $50,000 for income-focused strategies. The Merrill Guided Investing with Advisor program investment minimum is $20,000 for growth-focused strategies and $50,000 for income-focused strategies.

Footnote

5 There is an annual program fee of 0.45% based on the assets held in the account for the Merrill Guided Investing Program and there is an annual program fee of 0.85% based on the assets held in the account for the Merrill Guided Investing with Advisor Program. This fee is charged monthly in advance.

Footnote

6 Preferred Rewards Program Eligibility. You can enroll, and maintain your membership, in the Bank of America Preferred Rewards® program if you have an active, eligible personal checking account with Bank of America® and maintain the balance required for one of the balance tiers. The balance tiers are $20,000 for the Gold tier, $50,000 for the Platinum tier, $100,000 for the Platinum Honors tier, $1,000,000 for the Diamond tier and $10,000,000 for the Diamond Honors tier. Balances include your combined, qualifying Bank of America deposit accounts (such as checking, savings, certificate of deposit) and/or your Merrill investment accounts (such as

Cash Management Accounts, 529 Plans). You can satisfy the combined balance requirement for enrollment with either:

a three-month combined average daily balance in your qualifying deposit and investment accounts, or

a current combined balance, provided that you enroll at the time you open your first eligible personal checking account and satisfy the balance requirement at the end of at least one day within 30 days of opening that account.

Refer to your Personal Schedule of Fees for details on accounts that qualify towards the combined balance calculation and receive program benefits. Eligibility to enroll is generally available three or more business days after the end of the calendar month in which you satisfy the requirements. Benefits become effective within 30 days of your enrollment, or for new accounts within 30 days of account opening, unless we indicate otherwise. Bank of America Private Bank clients qualify to enroll in the Diamond Tier regardless of balance and may qualify for the Diamond Honors tier based on their qualifying Bank of America, Merrill and Private Bank balances. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on Bank of America employee qualification requirements, please call Employee Financial Services or refer to the Bank of America intranet site. Employees of companies participating in the Bank of America Employee Banking and Investing Program may be eligible to participate on customized terms. Refer to CEBI Program for details.

Footnote

Clients enrolled in Preferred Rewards receive a Preferred Rewards discount off the Merrill Guided Investing program's annual asset-based fee of 0.45%, and the Merrill Guided Investing with Advisor and Merrill Edge Advisory Account programs' annual asset-based fee of 0.85% for any of their accounts enrolled in the respective advisory programs. Preferred Rewards enrolled clients receive a discount of 0.05% off of the annual rate for the Gold tier, 0.10% for the Platinum tier, or 0.15% for the Platinum Honors, Diamond and Diamond Honors tiers based on their Preferred Rewards tier effective at the time the applicable advisory program fee is calculated. It may take up to 30 calendar days for changes to your Preferred Rewards status or tier to be associated with and effective for your accounts in the advisory programs. This fee is charged monthly in advance. In addition to the annual program fee, the expenses of the investments will vary based on the specific funds within each portfolio. Actual fund expenses will vary; please refer to each fund's prospectus.

Footnote 7 Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated with, but not limited to, margin transactions, special stock registration/gifting, account transfer and processing and termination apply. $0 option trades are subject to a $0.65 per-contract fee. Other fees and restrictions may apply. Pricing is subject to change without advance notice.

Leave a Comment

27 Comments

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank WolfTheCat

- Fund account to your tier level with cash or securities within 45 days of opening.

- Do not withdraw funds to go below your tier level within 90 days of funding.

- Become a preferred rewards member within 90 days of funding.

- After 90 days are over, you should be paid within two weeks.

- I recommend keeping the money in for those two weeks, but this is not a written requirement. Merrill may get ornery if you do.

I would LOVE to roll that over into a personal IRA. It's by far, my biggest account.

Have you tried making an in person appointment with a local Merrill rep? I did that when transferring my IRA from Schwab for the $200 bonus and preferred rewards. Very helpful.

BlackRock Liquidity Funds: FedFund --- Institutional Class7,8,* TFDXX 5.0%

I recently moved some money to Fidelity Investments and Fidelity automatically put my cash in a money account that pays 5% interest.

Much higher rate of return on the Merrill deal, but higher total return on Robinhood.

Much higher rate of return on the Merrill deal, but higher total return on Robinhood.

If you are just looking for bank bonuses there are others more lucrative than this offer. For example, $15k and direct deposit earn you $900 from Chase.

Sign up for a Slickdeals account to remove this ad.

If you are just looking for bank bonuses there are others more lucrative than this offer. For example, $15k and direct deposit earn you $900 from Chase.

Credit card bonuses even more because they are tax free.

But, brokerage bonuses are different. No.cash required - just securities that get the same return no matter who holds them.

You can do this one, be done by tax season, then use the same securities for a Robinhood bonus.

Basically Open Merill Account and put 100k into SGOV for ~5% back in dividends.

After 3 month rolling average, your BoFa Cash Rewards CC will have 5.25% cashback on internet or restaurant (your choice category) after platinum honors multiplier.

No need to let cash sit in your accounts gaining nothing.

I got on Gold and their gold CC, put 200k in at 5% interest + 1% boost, and less than a week later it dropped to 4.5% interest + 1% boost. (I know it's due to fed interest rate drop, but nothing good lasts)

The bond thing is disturbing though - I have about $100k on corporate and municipal bonds in the portfolio I intend to transfer.

I'm not trading them, but if they don't accept them or value them right, I might not hit the $250k for the max bonus.

BlackRock Liquidity Funds: FedFund --- Institutional Class7,8,* TFDXX 5.0%

I recently moved some money to Fidelity Investments and Fidelity automatically put my cash in a money account that pays 5% interest.

TFDXX is not available.

tfdxx is not available.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment