Note: This popular deal is still available.

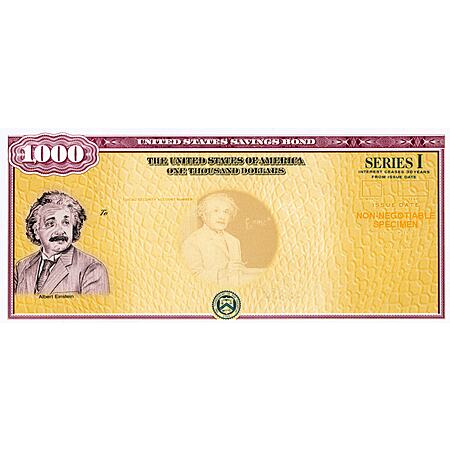

U.S, Government Treasury is currently offering

7.12% Interest Rate in combined

Fixed + Inflation Rate Earnings valid on newly issued

Series I Savings Bonds purchased from November 2021 through April 2022. Limit of $10,000 / year in interest earnings per person.

Thanks to community member

dn90003 for sharing this offer.

About this offer:- How do I buy a Series I bond?

- Must register or sign-in to your free TreasuryDirect.gov account and link a bank account.

- Click here to view a Guided Tour

- What is a Series I bond? (source)

- "A savings bond that earns interest based on combining a fixed rate and an inflation rate."

- You may use Series I bonds to:

- Save in a low-risk product that helps protect your savings from inflation

- Supplement your retirement income

- Give as a gift

- Pay for education

- Click here for more information about Series I Bonds

- What interest does a Series I bond earn? (source)

- A combination of a fixed rate that stays the same for the life of the bond and an inflation rate that is set twice a year.

- For bonds issued from November 2021 through April 2022, the combined rate is 7.12%

Leave a Comment

Top Comments

In case you're wondering, here's how the rate is computed:

Composite rate =

I bought $10k in denominations of 2,3, 5 so if I want to cash out I can do it in chunks instead of having to cash out $10k.: Better than any CD or bank rate if you want to stay in cash.

https://www.treasurydir

3,498 Comments

Sign up for a Slickdeals account to remove this ad.

10k in your name

10k in spouse's name

10k in your business name and/or trust

10k in spouse business and/or trust

also, overpay your federal taxes and have surplus rolled into I Bonds when you file the tax returns.

Sign up for a Slickdeals account to remove this ad.

1. Is the 3.56% return on $10356 assuming the $7.12% renews in April?

2. Let's assume the rate goes down to 6% even after April 2022, Will the money for the next 6 months grow at 6% and the compound of what I earned 6 months ago be at 3% or 3.56%?

1. Is the 3.56% return on $10356 assuming the $7.12% renews in April?

2. Let's assume the rate goes down to 6% even after April 2022, Will the money for the next 6 months grow at 6% and the compound of what I earned 6 months ago be at 3% or 3.56%?

If the rate goes down to 6% in April, your return will be 3% of the new, compounded total.

1. Is the 3.56% return on $10356 assuming the $7.12% renews in April?

2. Let's assume the rate goes down to 6% even after April 2022, Will the money for the next 6 months grow at 6% and the compound of what I earned 6 months ago be at 3% or 3.56%?

Let's assume your 6%. Then, in the 2nd 6 month period, the interest income (before penalty) is 3% of $10,356.

Sign up for a Slickdeals account to remove this ad.

For those who don't know, the $1-$2 Trillion quoted cost of the TCJA is over a 10 year period. It went into effect in 2018. If the current administration changes anything, then the $1.5 Trillion quoted could change significantly. To say that the tax cut has no macro economic benefit is debatable, because like you pointed out, there are other factors at play which interfered with our economy as a whole. The pandemic (or more precisely the policies implemented as a result of the pandemic) have been impacting our economy. To reach the conclusion; the TCJA has no macro economic benefit is hard to argue given the current pandemic policies.

I for one was not a fan of many aspects of the TCJA. I also believe it to be fair to criticize both parties and their policies.

Leave a Comment