- Amazon matches price of Costco of $10 off for TurboTax so it takes price from $49.99 to $39.99 just for the TurboTax so the price of the bundle will go from ($59.90 to $49.90)

- On 12/29 a $10 giftcard is included in the purchase so the GC will be "Free" so the price of the bundle will go from ($49.90 to $39.90)

Regarding "State" confusion, on Premier product page, it says:

Please clarify : State return software is included, but not for state filing. Is this true?

Answer:

TurboTax Premier 2021 includes "1 State via download ($40 value*). State e-file sold separately." This means you will get the download product for a state of your choosing in order to prepare and file it. E-filing your state return is sold separately but you can avoid that by choosing to print and mail instead of e-file.

Few Tips:

- No Sales Tax for Download Version in CA

- Can not use Amazon GC because it contains a GC

- Amazon Locker pickup discount does not work on this

Leave a Comment

Top Comments

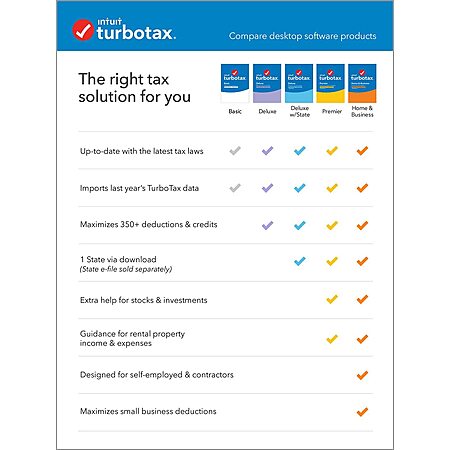

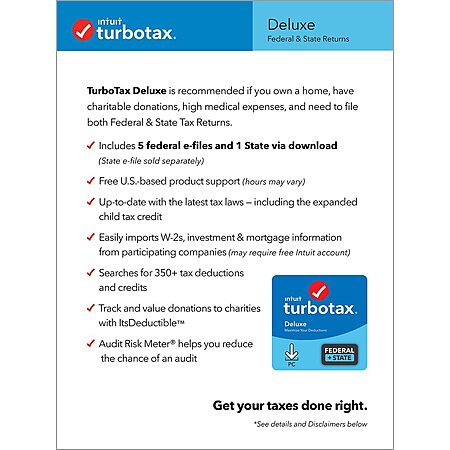

If you own your home, have bills to mind, or even contribute to charity from time to time, Deluxe will suffice. The Deluxe is also what you'll need to file the deductions on Schedule A.

Premier: If you have investments and rental properties, Premier will be better suited for your tax filing needs.

This is true if you are involved in stocks, have bonds, mutual funds or have a trust in your name because Premier covers Schedule D. Collecting rent would require you a Schedule E, and that is also included in the Premier.

Are you a recipient of the Schedule K-1? Look no further, Premier is the answer.

811 Comments

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank BeigeStew7045

Our community has rated this post as helpful. If you agree, why not thank CharlesBarkley

Our community has rated this post as helpful. If you agree, why not thank Galileo28

If you own your home, have bills to mind, or even contribute to charity from time to time, Deluxe will suffice. The Deluxe is also what you'll need to file the deductions on Schedule A.

Premier: If you have investments and rental properties, Premier will be better suited for your tax filing needs.

This is true if you are involved in stocks, have bonds, mutual funds or have a trust in your name because Premier covers Schedule D. Collecting rent would require you a Schedule E, and that is also included in the Premier.

Are you a recipient of the Schedule K-1? Look no further, Premier is the answer.

But need to use staples rewards to shop at staples, so probably going to be tax software. will cost me $10 more.

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank adamant

If you own your home, have bills to mind, or even contribute to charity from time to time, Deluxe will suffice. The Deluxe is also what you'll need to file the deductions on Schedule A.

Premier: If you have investments and rental properties, Premier will be better suited for your tax filing needs.

This is true if you are involved in stocks, have bonds, mutual funds or have a trust in your name because Premier covers Schedule D. Collecting rent would require you a Schedule E, and that is also included in the Premier.

Are you a recipient of the Schedule K-1? Look no further, Premier is the answer.

If you own your home, have bills to mind, or even contribute to charity from time to time, Deluxe will suffice. The Deluxe is also what you'll need to file the deductions on Schedule A.

Premier: If you have investments and rental properties, Premier will be better suited for your tax filing needs.

This is true if you are involved in stocks, have bonds, mutual funds or have a trust in your name because Premier covers Schedule D. Collecting rent would require you a Schedule E, and that is also included in the Premier.

Are you a recipient of the Schedule K-1? Look no further, Premier is the answer.

Our community has rated this post as helpful. If you agree, why not thank Galileo28

Google it, "While TurboTax Deluxe+State does include Schedule D and Form 8949, we do suggest TurboTax Premier to get the guided interview questions to ensure information is being accurately entered. ... While using Forms Mode will not prevent you from e-filing, it does void the TurboTax Accuracy Guarantee."

Our community has rated this post as helpful. If you agree, why not thank elbercho

The link for the premier took me to Deluxe. After some searching it looks like the premier is not included in the $10 gift card promo? Also note that, unlike prior years, you do not have the option to download if you order physical CD and folks who have received the CD say it messed up their prior year's files or gave them problems so be sure you back up your prior years files.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment