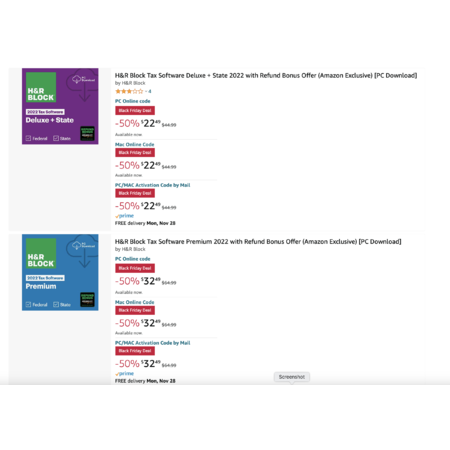

Residents with no state income tax can order: https://www.amazon.com/dp/B0BFXPN...yp_im

Free Tax Software:

1: Free Tax USA

https://www.freetaxusa.

2: IRS Free File: Do your Taxes for Free

https://www.irs.gov/filing/free-f...s-for-free

3: Cash App Taxes (Formally Credit Karma Tax)

https://cash.app/taxes

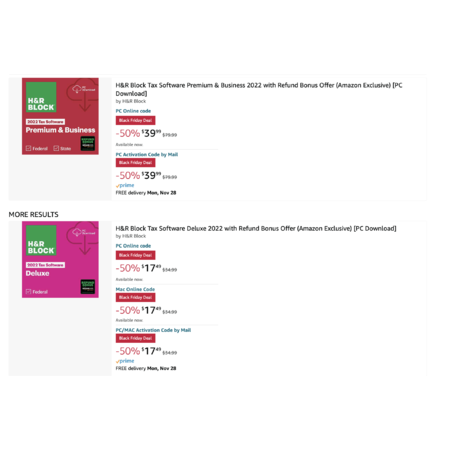

Careful on what version you buy!

The below only applies to the Download and Retail versions (both the "Digital Download" and the "Key Card" are the same version and both must be downloaded, the only difference is the delivery method of the product key). The Block Online packages of the same name have limited forms compared to the download version.

There is much confusion about versions as to what does what and I thought I'd post this to try to clear things up. Many believe that you need Premium or better if you are self employed or have rental income. That is not true. Self employment income and even LLCs along with rental income can be done with Deluxe or Basic. If you get to, corporations, Scorps and Partnerships you will need higher versions

Block likes to upsell you on the versions and there are almost outright deceptive marketing, wording and charts that cause much confusion about what version does what. Deluxe or even Basic will do the vast majority of returns even quite complicated ones.

Many mistakenly believe based on the charts and wording that Block puts out that you need Premium for things such as Schedule C, D & E. Deluxe handles all those forms but if you go by a chart or version picker on Block's site you will be guided to the higher version.

Here is the full list of supported forms for Deluxe Download version

You will see it is a quite extensive list and it will handle the vast majority of returns of your average taxpayers. The bolded text is just showing the most common forms but everything on the list is supported

|

Quote

:

Form 1040 and Schedules 1-3: US Individual Income TaxBackground Worksheet: Background Information Worksheet Dependents Worksheet: Worksheet for Dependents Dependents Att Worksheet: Dependents Attachment Worksheet Child Tax Credit Worksheet: Child Tax Credit Worksheet W-2 Worksheet: Wage and Tax Statement Non-W2 Wages: Worksheet for Wages Not on a W-2 IRA Contributions: IRA Contribution Worksheet Keogh/SEP/SIMPLE Contributions: Keogh/SEP/SIMPLE and Other Contributions Form 1098-E: Student Loan Interest Form 1099-G: Certain Government Payments 1099-R Worksheet: Distributions from Pensions, etc. Social Security Worksheet: Worksheet for Social Security Income 1099-MISC Worksheet: Miscellaneous Income 1099-K Worksheet: Payment Card Network Transactions Attachments Worksheet: Form 1040 Attachments Worksheet Last Year's Data Worksheet: Last Year's Data Worksheet W-2G Worksheet: Statement of Gambling Income Incentive Stock Option Worksheet: Incentive Stock Option Worksheet Self-Employed Health Insurance: Self-Employed Health Insurance Self-Employed Health Iterative: Self-Employed Health Iterative Self-Employed Health Refigure: Self-Employed Health Refigure Foreign Wages Not on a W-2: Foreign Wages Not on a W-2 Schedule 8812: Additional Child Tax Credit Schedule A: Itemized Deductions Home Mortgage Interest Worksheet: Home Mortgage Interest Worksheet Charitable Worksheet: Charitable Donations Worksheet Noncash or Item Donations: Noncash or Item Donations State and Local Income Tax: State and Local Income Tax Payments Worksheet Schedule B: Interest and Dividends Interest Summary: Interest Income Summary Form 1099-INT/OID: Interest Income Worksheet Dividend Summary: Dividend Income Summary Form 1099-DIV: Dividends and Distributions Form 8938: Statement of Specified Financial Assets Schedule C: Profit or Loss from Business Schedule D: Capital Gains and Losses Form 1099-B Account: Form 1099-B Account Capital Gains and Losses Worksheet: Capital Gains and Losses Sale of Home Worksheet: Sale of Home Worksheet Form 8949: Dispositions of Capital Assets Schedule E: Rents, Royalties, Partnerships, Etc. Schedule E Part I Attachment: Schedule E Part I Attachment Schedule E Part II Attachment: Schedule E Part II Attachment Schedule E Part III Attachment: Schedule E Part III Attachment Rentals and Royalties: Rentals and Royalties Worksheet K-1 Partnership/S Corporation: K-1 (Partnership/S Corporation) Worksheet K-1 Estate/Trust: K-1 (Estate/Trust) Worksheet Schedule EIC: Earned Income Credit Schedule F: Profit or Loss from Farming Schedule H: Household Employment Taxes Schedule J: Income Averaging for Farmers & Fishermen Schedule R: Credit for Elderly or Disabled Elderly/Disabled Credit: Worksheet for Elderly or Disabled Credit Schedule SE: Self-Employment Tax Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness Form 1116: Computation of Foreign Tax Credit Form 1116 (AMT): Foreign Tax Credit for AMT Form 1310: Refund Due a Deceased Taxpayer Form 2106: Employee Business Expenses Form 2120: Multiple Support Declaration Form 2210: Underpayment Penalty Form 2210, Schedule AI: Underpayment of Estimated Tax--Sch. AI Form 2439: Undistributed Long-Term Capital Gains Form 2441: Child and Dependent Care Credit Child/Dependent Care: Child/Dependent Care Worksheet Form W-10: Dependent Care Provider Form 2555: Foreign Earned Income Form 3468: Investment Credit Form 3800: General Business Credit Form 3903: Moving Expenses Form 4137: Social Security Tax on Unreported Tips Form 4562: Depreciation and Amortization Depreciation Summary: Summary of Assets Depreciation Worksheet: Depreciation Worksheet Vehicle Worksheet: Vehicle Expense Worksheet Bonus Depreciation Election Out: Bonus Depreciation Election Out Form 4684: Casualties and Thefts Form 4797: Sales of Business Property Form 4835: Farm Rental Income and Expenses Form 4868: Automatic Extension of Time to File Form 4952: Investment Interest Expense Form 4972: Tax on Lump-Sum Distributions Form 5329: Return for IRA and Retirement Plan Tax Form 5405: Repayment of First-Time Homebuyer Credit Form 5695: Residential Energy Credits Form 6198: At Risk Limitations Form 6251: Alternative Minimum Tax Form 6252: Installment Sale Income Form 6781: Section 1256 Contracts Form 8283: Noncash Charitable Contributions Form 8332: Release of Claim to Exemption Form 8379: Injured Spouse Allocation Form 8396: Mortgage Interest Credit Form 8453: US Individual Transmittal for On-Line Filing Form 8582 - Page 1: Passive Activity Loss Limitations Form 8582 Page 2 (Regular Tax): Passive Activity Loss Limitations Form 8582 Page 3 (Regular Tax): Passive Activity Loss Limitations Form 8582 Page 2 (AMT): Passive Activity Loss Limitations Form 8582 Page 3 (AMT): Passive Activity Loss Limitations Form 8586: Low-Income Housing Credit Form 8606: Nondeductible IRAs 8606 Worksheet: Form 8606 Worksheet Returned IRA Contributions: Returned IRA Contributions Form 8609-A: Annual Statement for Low-Income Housing Credit Form 8615: Child With Unearned Income Form 8801: Credit for Prior Year Minimum Tax Form 8814: Parents' Election for Child's Income Form 8815: Exclusion of Interest from Savings Bonds Form 8818: Redemption of EE and I US Savings Bonds Form 8822: Change of Address Form 8822-B: Change of Address - Business Form 8824: Like-Kind Exchanges Form 8829: Expenses for Business Use of Your Home Form 8839: Qualified Adoption Expenses Form 8853: MSA Deduction Form 8859: District of Columbia First-Time Homebuyer Credit Form 8862: Information to Claim Certain Credits Form 8863: Education Credits Tuition Payments: Tuition Payments Worksheet Form 8880: Credit for Qualified Retirement Savings Contributions Form 8885: Health Coverage Tax Credit Form 8888: Allocation of Refund (Including Savings Bond Purchases) Form 8889: Health Savings Accounts (HSAs) Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit Form 8958: Allocation of Tax Amounts in Community Property States Form 8959: Additional Medicare Tax Form 8960: Net Investment Income Tax Form 8962: Premium Tax Credit Form 8962 Information: Form 8962 Information Form 1095-A: Health Insurance Marketplace Statement Form 8962 Part IV Attachment: Form 8962 Part IV Attachment Form 8995: Qualified Business Income Deduction Simplified Computation Form 8995-A Summary: Qualified Business Income Summary Form 8995-A: Qualified Business Income Deduction Form 8995-A Schedule A: Specified Services Trade or Business Form 8995-A Schedule C: Loss Netting and Carryforward Form 8995-A Schedule D: Special Rules for Patrons of Cooperatives QBI Statement: Qualified Business Income Statement Form 9465: Installment Payments of Tax Form 1040-SR and Schedules 1 - 3: US Tax Return for Seniors Form 1040-V: Payment Voucher Form 1040X: Amended U.S. Individual Income Tax Return Form 1040-ES: Estimated Tax Form SS-4: Application for Employer Identification Number W-4 Worksheet: Employee's Withholding Allowance Certificate H&R Block Tax Payment Planner: H&R Block Tax Payment Planner Roth Conversions: Roth Conversion Worksheet Roth Contributions: Roth Contribution Worksheet Filing Status Calculator: Married Filing Joint vs. Separate Calculator State Information: State Information Worksheet Other State Tax Credit: Other State Tax Credit Worksheet De Minimis Safe Harbor: De Minimis Safe Harbor Small Taxpayer Safe Harbor: Small Taxpayer Safe Harbor Clergy Worksheet 1: Clergy Worksheet 1 Clergy Worksheet 2: Clergy Worksheet 2 Clergy Worksheet 3: Clergy Worksheet 3 Clergy 2106 Expense Statement: Clergy Worksheet for SE Tax Employee Business Expenses |

Leave a Comment

Top Comments

https://www.cnbc.com/2022/11/22/popular-tax-prep-software-sent-financial-information-to-meta-report.... [cnbc.com]

the software sent information like names, email addresses, income information and refund amounts to Meta

https://www.theverge.co

152 Comments

Sign up for a Slickdeals account to remove this ad.

For anyone who has been getting the weird error checking out with the Amazon Prime Visa card (for the 20% back in rewards), try again. It failed a few times, still, but then it finally went through. Just be sure to keep checking the checkbox to use the no-rush credits as it automatically seems to deselect each time it fails.

Sign up for a Slickdeals account to remove this ad.

HTH

The below only applies to the Download and Retail versions (both the "Digital Download" and the "Key Card" are the same version and both must be downloaded, the only difference is the delivery method of the product key). The Block Online packages of the same name have limited forms compared to the download version.

There is much confusion about versions as to what does what and I thought I'd post this to try to clear things up. Many believe that you need Premium or better if you are self employed or have rental income. That is not true. Self employment income and even LLCs along with rental income can be done with Deluxe or Basic. If you get to, corporations, Scorps and Partnerships you will need higher versions

Block likes to upsell you on the versions and there are almost outright deceptive marketing, wording and charts that cause much confusion about what version does what. Deluxe or even Basic will do the vast majority of returns even quite complicated ones.

Many mistakenly believe based on the charts and wording that Block puts out that you need Premium for things such as Schedule C, D & E. Deluxe handles all those forms but if you go by a chart or version picker on Block's site you will be guided to the higher version.

Here is the full list of supported forms for Deluxe Download version

You will see it is a quite extensive list and it will handle the vast majority of returns of your average taxpayers. The bolded text is just showing the most common forms but everything on the list is supported

Background Worksheet: Background Information Worksheet

Dependents Worksheet: Worksheet for Dependents

Dependents Att Worksheet: Dependents Attachment Worksheet

Child Tax Credit Worksheet: Child Tax Credit Worksheet

W-2 Worksheet: Wage and Tax Statement

Non-W2 Wages: Worksheet for Wages Not on a W-2

IRA Contributions: IRA Contribution Worksheet

Keogh/SEP/SIMPLE Contributions: Keogh/SEP/SIMPLE and Other Contributions Form 1098-E: Student Loan Interest

Form 1099-G: Certain Government Payments

1099-R Worksheet: Distributions from Pensions, etc.

Social Security Worksheet: Worksheet for Social Security Income

1099-MISC Worksheet: Miscellaneous Income

1099-K Worksheet: Payment Card Network Transactions

Attachments Worksheet: Form 1040 Attachments Worksheet

Last Year's Data Worksheet: Last Year's Data Worksheet

W-2G Worksheet: Statement of Gambling Income

Incentive Stock Option Worksheet: Incentive Stock Option Worksheet

Self-Employed Health Insurance: Self-Employed Health Insurance

Self-Employed Health Iterative: Self-Employed Health Iterative

Self-Employed Health Refigure: Self-Employed Health Refigure

Foreign Wages Not on a W-2: Foreign Wages Not on a W-2

Schedule 8812: Additional Child Tax Credit

Schedule A: Itemized Deductions

Home Mortgage Interest Worksheet: Home Mortgage Interest Worksheet

Charitable Worksheet: Charitable Donations Worksheet

Noncash or Item Donations: Noncash or Item Donations

State and Local Income Tax: State and Local Income Tax Payments Worksheet

Schedule B: Interest and Dividends

Interest Summary: Interest Income Summary

Form 1099-INT/OID: Interest Income Worksheet

Dividend Summary: Dividend Income Summary

Form 1099-DIV: Dividends and Distributions

Form 8938: Statement of Specified Financial Assets

Schedule C: Profit or Loss from Business

Schedule D: Capital Gains and Losses

Form 1099-B Account: Form 1099-B Account

Capital Gains and Losses Worksheet: Capital Gains and Losses

Sale of Home Worksheet: Sale of Home Worksheet

Form 8949: Dispositions of Capital Assets

Schedule E: Rents, Royalties, Partnerships, Etc.

Schedule E Part I Attachment: Schedule E Part I Attachment

Schedule E Part II Attachment: Schedule E Part II Attachment

Schedule E Part III Attachment: Schedule E Part III Attachment

Rentals and Royalties: Rentals and Royalties Worksheet

K-1 Partnership/S Corporation: K-1 (Partnership/S Corporation) Worksheet

K-1 Estate/Trust: K-1 (Estate/Trust) Worksheet

Schedule EIC: Earned Income Credit

Schedule F: Profit or Loss from Farming

Schedule H: Household Employment Taxes

Schedule J: Income Averaging for Farmers & Fishermen

Schedule R: Credit for Elderly or Disabled

Elderly/Disabled Credit: Worksheet for Elderly or Disabled Credit

Schedule SE: Self-Employment Tax

Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness

Form 1116: Computation of Foreign Tax Credit

Form 1116 (AMT): Foreign Tax Credit for AMT

Form 1310: Refund Due a Deceased Taxpayer

Form 2106: Employee Business Expenses

Form 2120: Multiple Support Declaration

Form 2210: Underpayment Penalty

Form 2210, Schedule AI: Underpayment of Estimated Tax--Sch. AI

Form 2439: Undistributed Long-Term Capital Gains

Form 2441: Child and Dependent Care Credit

Child/Dependent Care: Child/Dependent Care Worksheet

Form W-10: Dependent Care Provider

Form 2555: Foreign Earned Income

Form 3468: Investment Credit

Form 3800: General Business Credit

Form 3903: Moving Expenses

Form 4137: Social Security Tax on Unreported Tips

Form 4562: Depreciation and Amortization

Depreciation Summary: Summary of Assets

Depreciation Worksheet: Depreciation Worksheet

Vehicle Worksheet: Vehicle Expense Worksheet

Bonus Depreciation Election Out: Bonus Depreciation Election Out

Form 4684: Casualties and Thefts

Form 4797: Sales of Business Property

Form 4835: Farm Rental Income and Expenses

Form 4868: Automatic Extension of Time to File

Form 4952: Investment Interest Expense

Form 4972: Tax on Lump-Sum Distributions

Form 5329: Return for IRA and Retirement Plan Tax

Form 5405: Repayment of First-Time Homebuyer Credit

Form 5695: Residential Energy Credits

Form 6198: At Risk Limitations

Form 6251: Alternative Minimum Tax

Form 6252: Installment Sale Income

Form 6781: Section 1256 Contracts

Form 8283: Noncash Charitable Contributions

Form 8332: Release of Claim to Exemption

Form 8379: Injured Spouse Allocation

Form 8396: Mortgage Interest Credit

Form 8453: US Individual Transmittal for On-Line Filing

Form 8582 - Page 1: Passive Activity Loss Limitations

Form 8582 Page 2 (Regular Tax): Passive Activity Loss Limitations

Form 8582 Page 3 (Regular Tax): Passive Activity Loss Limitations

Form 8582 Page 2 (AMT): Passive Activity Loss Limitations

Form 8582 Page 3 (AMT): Passive Activity Loss Limitations

Form 8586: Low-Income Housing Credit

Form 8606: Nondeductible IRAs

8606 Worksheet: Form 8606 Worksheet

Returned IRA Contributions: Returned IRA Contributions

Form 8609-A: Annual Statement for Low-Income Housing Credit

Form 8615: Child With Unearned Income

Form 8801: Credit for Prior Year Minimum Tax

Form 8814: Parents' Election for Child's Income

Form 8815: Exclusion of Interest from Savings Bonds

Form 8818: Redemption of EE and I US Savings Bonds

Form 8822: Change of Address

Form 8822-B: Change of Address - Business

Form 8824: Like-Kind Exchanges

Form 8829: Expenses for Business Use of Your Home

Form 8839: Qualified Adoption Expenses

Form 8853: MSA Deduction

Form 8859: District of Columbia First-Time Homebuyer Credit

Form 8862: Information to Claim Certain Credits

Form 8863: Education Credits

Tuition Payments: Tuition Payments Worksheet

Form 8880: Credit for Qualified Retirement Savings Contributions

Form 8885: Health Coverage Tax Credit

Form 8888: Allocation of Refund (Including Savings Bond Purchases)

Form 8889: Health Savings Accounts (HSAs)

Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit

Form 8958: Allocation of Tax Amounts in Community Property States

Form 8959: Additional Medicare Tax

Form 8960: Net Investment Income Tax

Form 8962: Premium Tax Credit

Form 8962 Information: Form 8962 Information

Form 1095-A: Health Insurance Marketplace Statement

Form 8962 Part IV Attachment: Form 8962 Part IV Attachment

Form 8995: Qualified Business Income Deduction Simplified Computation

Form 8995-A Summary: Qualified Business Income Summary

Form 8995-A: Qualified Business Income Deduction

Form 8995-A Schedule A: Specified Services Trade or Business

Form 8995-A Schedule C: Loss Netting and Carryforward

Form 8995-A Schedule D: Special Rules for Patrons of Cooperatives

QBI Statement: Qualified Business Income Statement

Form 9465: Installment Payments of Tax

Form 1040-SR and Schedules 1 - 3: US Tax Return for Seniors

Form 1040-V: Payment Voucher

Form 1040X: Amended U.S. Individual Income Tax Return

Form 1040-ES: Estimated Tax

Form SS-4: Application for Employer Identification Number

W-4 Worksheet: Employee's Withholding Allowance Certificate

H&R Block Tax Payment Planner: H&R Block Tax Payment Planner

Roth Conversions: Roth Conversion Worksheet

Roth Contributions: Roth Contribution Worksheet

Filing Status Calculator: Married Filing Joint vs. Separate Calculator

State Information: State Information Worksheet

Other State Tax Credit: Other State Tax Credit Worksheet

De Minimis Safe Harbor: De Minimis Safe Harbor

Small Taxpayer Safe Harbor: Small Taxpayer Safe Harbor

Clergy Worksheet 1: Clergy Worksheet 1

Clergy Worksheet 2: Clergy Worksheet 2

Clergy Worksheet 3: Clergy Worksheet 3

Clergy 2106 Expense Statement: Clergy Worksheet for SE Tax Employee Business Expenses

Sign up for a Slickdeals account to remove this ad.

Leave a Comment