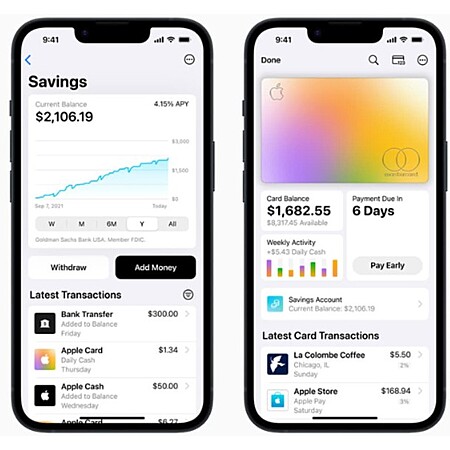

Apple is offering an

Apple Card Savings Account with 4.15% Interest.

Thanks to Community Member

SUCHaDEAL for finding this deal.

- High-yield APY of 4.15%

- No Fees

- No Minimum Deposits

- No Minimum Balance Requirements

- No Foreign Transaction Fees

What you need to open and maintain an account:- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

How to set up Savings:- On your iPhone, open the Wallet app and tap Apple Card.

- Tap the More button, then tap Daily Cash.

- Tap Set Up next to Savings, then follow the onscreen instructions.

- Additional Setup Information

Leave a Comment

Top Comments

https://learn.applecard

https://wallet.apple.co

526 Comments

Sign up for a Slickdeals account to remove this ad.

This is a goldman sachs savings account that apple merely "wrapped" and added value on top of by letting you deposit your cashback into directly?

This one just launched, so it's going to be a little above average to attract customers. Everyone else is going to slowly climb over the next several weeks.

Overall constantly switching banks will earn you a couple dollars a year. Spend the time learning a skill or doing a job and you could earn much more than that.

If you're already in the Apple Card ecosystem this might be convenient and worthwhile to consolidate. For everyone else, likely not.

Our community has rated this post as helpful. If you agree, why not thank qAnon20201231

Our community has rated this post as helpful. If you agree, why not thank gorillatechman

My suggestion, open an Apple account, link it to your Ally account for transfers and vice versa. Then you can move money back and forth to play the rates keeping at least the minimum to keep the other account active/open.

I opened a few 4.75% no penalty CDs at Ally some months ago, and it can be closed whenever you like, without penalty. I don't think that rate is available anymore, but if somebody is interested in getting the highest rates they can, then they should pay attention to all options, as they are constantly changing.

Sign up for a Slickdeals account to remove this ad.

When you apply for an Apple Card, if they accept you, they will make an offer, showing you what credit limit they will give you.

You can then either choose to accept or decline.

If you decline, then it'll only be a soft pull on your credit.

If you accept, you will get a hard pull, just like with any other card.

I opened a few 4.75% no penalty CDs at Ally some months ago, and it can be closed whenever you like, without penalty. I don't think that rate is available anymore, but if somebody is interested in getting the highest rates they can, then they should pay attention to all options, as they are constantly changing.

On a seriously note, I'm tempted to apply for Apple Card and get a savings account since most CDs don't have as good interest.

Sign up for a Slickdeals account to remove this ad.

It does sound very sketchy though, and it's not something that I would have tried to do, because it seems like it can only lead to problems down the line. Why would somebody do that, to commit fraud? To lie about their income or details?

Leave a Comment