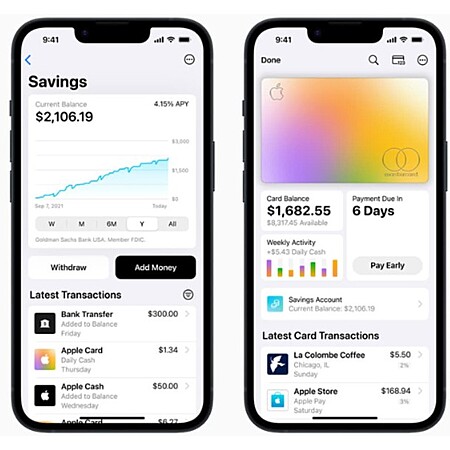

Apple is offering an

Apple Card Savings Account with 4.15% Interest.

Thanks to Community Member

SUCHaDEAL for finding this deal.

- High-yield APY of 4.15%

- No Fees

- No Minimum Deposits

- No Minimum Balance Requirements

- No Foreign Transaction Fees

What you need to open and maintain an account:- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

How to set up Savings:- On your iPhone, open the Wallet app and tap Apple Card.

- Tap the More button, then tap Daily Cash.

- Tap Set Up next to Savings, then follow the onscreen instructions.

- Additional Setup Information

Leave a Comment

Top Comments

https://learn.applecard

https://wallet.apple.co

526 Comments

Sign up for a Slickdeals account to remove this ad.

On a seriously note, I'm tempted to apply for Apple Card and get a savings account since most CDs don't have as good interest.

You're also correct that you can not withdraw just a portion of a CD. You would have to close the entire CD. I opened up multiple CDs, which was one way to protect myself, in case I needed to withdraw unexpectedly. I can just close one of them, while leaving the others open.

I also agree with your last option. I just have multiple accounts in various banks and they're all linked, so it's easy to just move money from A to B whenever needed, if the rates at bank B are much better than A for example. And vice versa of course.

I'm more of a Google Pay guy, but I have an iPad and an Apple card. I love the notifications of upcoming charges for subscriptions, the ability to set up payments in Settings, and 3% on all Apple purchases, 2% on Apple pay, and 1% on anything else.

I'm more of a Google Pay guy, but I have an iPad and an Apple card. I love the notifications of upcoming charges for subscriptions, the ability to set up payments in Settings, and 3% on all Apple purchases, 2% on Apple pay, and 1% on anything else.

Apple is the United States of America.

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank qAnon20201231

2% earned from Apple Card (via ApplePay) deposits into Apple Cash that earns no interest

With Apple Savings Account , the Apple Card 2% cash back gets deposited straight into Apple Savings earning 4.15% interest today as opposed to 0% in Apple Cash.

You're also correct that you can not withdraw just a portion of a CD. You would have to close the entire CD. I opened up multiple CDs, which was one way to protect myself, in case I needed to withdraw unexpectedly. I can just close one of them, while leaving the others open.

I also agree with your last option. I just have multiple accounts in various banks and they're all linked, so it's easy to just move money from A to B whenever needed, if the rates at bank B are much better than A for example. And vice versa of course.

yes, opening multiple CD's is a good idea for 'rainy day' early redemption on a no-penalty.

I'm more of a Google Pay guy, but I have an iPad and an Apple card. I love the notifications of upcoming charges for subscriptions, the ability to set up payments in Settings, and 3% on all Apple purchases, 2% on Apple pay, and 1% on anything else.

I'm more of a Google Pay guy, but I have an iPad and an Apple card. I love th the notifications of upcoming charges for subscriptions, the ability to set up payments in Settings, and 3% on all Apple purchases, 2% on Apple pay, and 1% on anything else.

Sign up for a Slickdeals account to remove this ad.

Note: I had an error the first time I tried. It went through the second time but went back to the cash screen. The third time it worked fine.

Leave a Comment