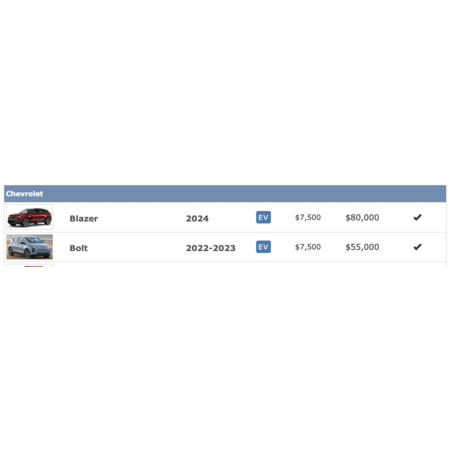

Beginning in 2024, everyone under the income limit qualifies for the full $7,500 rebate. It does not matter if you owe less than that in taxes, and you can get it at the time of purchase instead of waiting for next year's taxes.

https://www.npr.org/2023/12/28/12...ford-vw-gm

frontpageDC13 posted Jun 03, 2023 09:12 PM

Item 1 of 13

Item 1 of 13

frontpageDC13 posted Jun 03, 2023 09:12 PM

2023 Chevrolet Bolt EV 1LT + $7500 Tax Credit + In-Home Charger Install

(For Qualifying Buyers)from $26500

$26,500

Good Deal

Bad Deal

Save

Share

Leave a Comment

Top Comments

edit: For clarification from the wiki: "The tax credit is not refundable, which means one must have federal tax due to take advantage of it. If the tax due is less than the credit amount, one can only claim the credit up to the amount of the tax due."

So lower income people will not get a $7500 refund, it depends on your liability. i.e. A SDer responded about a student being angry in a previous thread that they only got $500 back and not $7500.

Virtually all of the ICE vehicle can be recycled. Generally the only items not recyclable per se will be interior trim - it's mixed plastic and rubber. Engine? steel or aluminum. Gearcases? Steel or aluminum. Body, frame, etc, steel or aluminum. In fact, about 86% of a car can be recycled [recyclenation.com].

Meanwhile your EV will still have a fully and readily recyclable frame and body, just like the ICE. The motor will generally be recyclable. The battery? Not really. Generally batteries and battery packs are not really designed for recycling. Most are just thousands of individual cylindrical cells, that themselves are spiral wound multilayer structures. There's no easy way to separate the materials here. An ICE, you literally rip out the engine with heavy equipment and include it in with any other steel or aluminum - the process is astonishingly easy and quick [youtube.com] with heavy equipment.

Meanwhile, the batteries are generally just shredded [ucsusa.org]. The resulting material is called "black mass" and is placed into a bath of caustic chemicals to leech out the *important* elements. In certain cases, that black mass is first incinerated to burn off plastic and epoxies. Yeah that sounds super efficient and environmental to me.

1,102 Comments

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank nojmplease

Yes, the Bolt can be a great deal, but putting the pricing in the headline like that is extremely misleading IMO.

Our community has rated this post as helpful. If you agree, why not thank Cecerious

That being said, if you live in a major city, good luck finding a Bolt that isn't over MSRP

Sign up for a Slickdeals account to remove this ad.

That being said, you can still adjust your withholding if you want to start preparing/offsetting for the large credit that will be awarded in your 2023 taxes. Again, this is not required to qualify for the tax credit. This is NOT required and would even advise caution to be careful so as to not incur an IRS penalty for too little tax withholding.

Our community has rated this post as helpful. If you agree, why not thank TruongKy

$19k is VERY YMMV

That being said, if you live in a major city, good luck finding a Bolt that isn't over MSRP

Our community has rated this post as helpful. If you agree, why not thank CoralWeather

Range is pretty great, the car is surprisingly spacious inside (no problem fitting a few car seats in), and Chevy's free installation of the receptacle means I just plug in the car overnight and have a full battery by morning. Coming from Japanese cars, and hating every Chevy rental I've ever driven, I didn't expect to love the car as much as I do. The instant torque and smooth ride really make it a fun vehicle to drive.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment