You might also have 6x cashback from your Amex card, if you are targeted: https://offer.love/?search=amazon.

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

Item 1 of 1

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

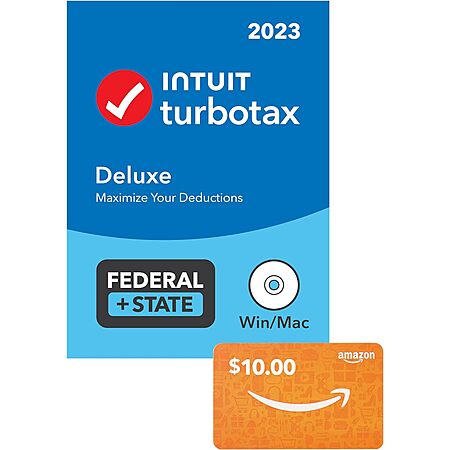

TurboTax Deluxe + State 2023 + $10 Amazon Gift Card (PC/Mac Physical Disc)

& More + Free Shipping$45

$80

43% offAmazon

Visit AmazonGood Deal

Bad Deal

Save

Share

Leave a Comment

Top Comments

Gotta love our corrupt system, causing people to spend millions of extra dollars and God knows how many man-hours filing tax returns that really have no reason to exist in this day and age.

191 Comments

Sign up for a Slickdeals account to remove this ad.

It's either Federal only download or Federal + State CD on Amazon and other retailers.

It's either Federal only download or Federal + State CD on Amazon and other retailers.

What most people are asking for is the government to guess based on incomplete information which would need to be updated and corrected for a vast majority of people. Therefore, the taxpayer doesnt save that much time as they would still need to review every input that was complete and accurate.

What would actually end up happening is the government would end up sending out estimates and two things would happen. 1) Many people that do not want to spend the time with a program like TurboTax or the free ones would be ignorant of the deductions they should be receiving so they end up paying too much, or 2) many immigrants would overpay as because they would be too fearful challenging a government entity estimates.

I am a CPA in California and work with a lot of low-income earners and having the government assume what a person should pay would be a disaster.

Agree-for the "average" taxpayer, it would be nice to have a "here's what you owe" sheet.

I recently heard the best reason for why "government is a mess." Unlike a business, the government must serve 100% of the market. They cannot choose their customers or market segment, and need to serve EVERYONE'S special cases.

Sign up for a Slickdeals account to remove this ad.

I have been buying these TT deluxe + AGC bundles for many years now. Supports retrieving transaction data from many brokerages automatically saving considerable time.

In my opinion, unless you are dealing with a situation that for some reason only one of the tax programs can address (happened to me a few years back), just use whatever is free or closest to free as possible. They are all very very good.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment