You might also have 6x cashback from your Amex card, if you are targeted: https://offer.love/?search=amazon.

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

Item 1 of 1

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

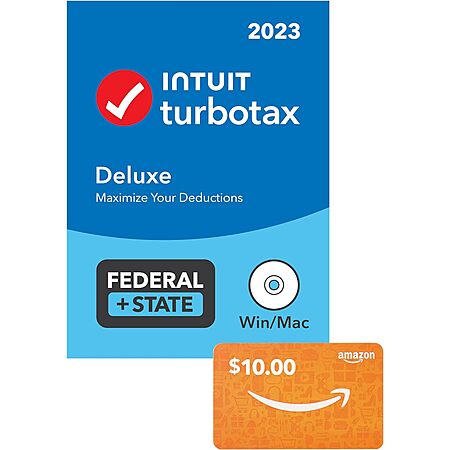

TurboTax Deluxe + State 2023 + $10 Amazon Gift Card (PC/Mac Physical Disc)

& More + Free Shipping$45

$80

43% offAmazon

Visit AmazonGood Deal

Bad Deal

Save

Share

Leave a Comment

Top Comments

Gotta love our corrupt system, causing people to spend millions of extra dollars and God knows how many man-hours filing tax returns that really have no reason to exist in this day and age.

191 Comments

Sign up for a Slickdeals account to remove this ad.

Can someone re/confirm that I can use Deluxe to:

- Import (and manually enter if one of my brokerage - e.g. Webull isn't supported) all my stock and option sales?

- Does it include and handle sale of ESPP shares from my employer? They do report the discount on W2 and also send Form 3922 to calculate the adjusted cost basis

- Does it include and handle rental property depreciation? I have previous calculations from past years that are carried forward from Schedule E.

- Lastly, does it include and handle Profit or Loss from Business (Schedule C) & Qualified Business Income deduction from Form 8995/8995-A?

Thanks in advance!What most people are asking for is the government to guess based on incomplete information which would need to be updated and corrected for a vast majority of people. Therefore, the taxpayer doesnt save that much time as they would still need to review every input that was complete and accurate.

What would actually end up happening is the government would end up sending out estimates and two things would happen. 1) Many people that do not want to spend the time with a program like TurboTax or the free ones would be ignorant of the deductions they should be receiving so they end up paying too much, or 2) many immigrants would overpay as because they would be too fearful challenging a government entity estimates.

I am a CPA in California and work with a lot of low-income earners and having the government assume what a person should pay would be a disaster.

Plus saying that those countries do not require their citizens to pay for filing is 1) funny because they commonly have additional taxes Americans do not pay, and 2) there are lots of free filing options for Americans.

And when it comes to spending time, are you saying if the US government sent you a notice of how much more you may owe, you would just assume its accuracy and wouldnt spend any time questioning it one bit? Wow.

Plus saying that those countries do not require their citizens to pay for filing is 1) funny because they commonly have additional taxes Americans do not pay, and 2) there are lots of free filing options for Americans.

And when it comes to spending time, are you saying if the US government sent you a notice of how much more you may owe, you would just assume its accuracy and wouldnt spend any time questioning it one bit? Wow.

If you want taxes to be as simple for everyone given the millions of situations, the best way is to have programs that walk you through the process by asking questions to help identify what a person's situation is. Like it is now.

Sign up for a Slickdeals account to remove this ad.

If you want taxes to be as simple for everyone given the millions of situations, the best way is to have programs that walk you through the process by asking questions to help identify what a person's situation is. Like it is now.

But again, all this is wishful thinking and I don't think there's willingness in our Govt to do it - especially due to the lobbying by these companies and CPAs. Good luck for your tax season. Peace.

But again, all this is wishful thinking and I don't think there's willingness in our Govt to do it - especially due to the lobbying by these companies and CPAs. Good luck for your tax season. Peace.

Sign up for a Slickdeals account to remove this ad.

Can someone re/confirm that I can use Deluxe to:

- Import (and manually enter if one of my brokerage - e.g. Webull or Coinbase isn't supported) all my stock, option, or crypto sales?

- Does it include and handle sale of ESPP shares from my employer? They do report the discount on W2 and also send Form 3922 to calculate the adjusted cost basis

- Does it include and handle rental property depreciation? I have previous calculations from past years that are carried forward from Schedule E.

- Lastly, does it include and handle Profit or Loss from Business (Schedule C) & Qualified Business Income deduction from Form 8995/8995-A?

Thanks in advance!I have always gotten the Premiere version (sharing with family members, so it's relatively inexpensive). Bought the Home and Business this year to try it out (we have a small LLC that generates some money). Worse case is that I feel it's unnecessary and will try another version next year. Maybe if I don't need the H+B I'll get the Deluxe next year (similar to what I described above).

Leave a Comment