Amazon.com Services LCC via Amazon has

TurboTax Premier Federal + State 2023 (PC/Mac Download) for

$64.99.

Note: After purchase, you can download this item any time from Your Games and Software Library. The number of computers eligible for installation may vary.

Thanks to Community Member

sssdddaaa222 for finding this deal.

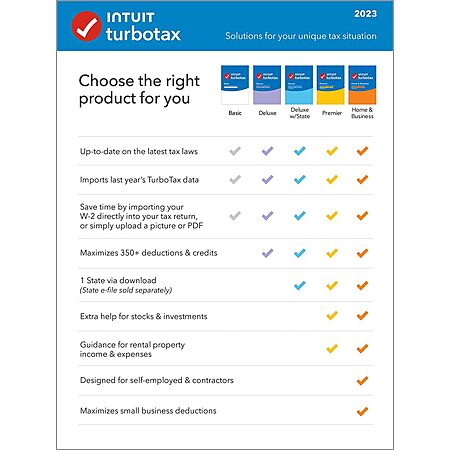

About this product:- Recommended if you sold stock, bonds or mutual funds, sold employee stock, own rental property or are a trust beneficiary

- Includes 5 Federal e-files and 1 State via download. State e-file sold separately. Free U.S.-based product support (hours may vary).

- Get your taxes done right and keep more of your investment and rental property income

- Step-by-step guidance on stocks, bonds, ESPPs and other investment income

- Up-to-date with the latest tax laws

Leave a Comment

Top Comments

https://www.amazon.com/gp/product/B0CNBLKJ9H

154 Comments

Sign up for a Slickdeals account to remove this ad.

Our community has rated this post as helpful. If you agree, why not thank fleetmack

https://ttlc.intuit.com/community...00/1023896

"If your investing income is limited to interest and dividends, then yes, you can use TurboTax Deluxe and download information from your financial institution. If you have capital gains/losses and need to file Schedule D, you will need to use TurboTax Premier. With Premier you will be able to download information for dividends, interest, and sales and purchases of stocks, bonds, mutual funds, etc."

https://ttlc.intuit.com/community...00/1023896

"If your investing income is limited to interest and dividends, then yes, you can use TurboTax Deluxe and download information from your financial institution. If you have capital gains/losses and need to file Schedule D, you will need to use TurboTax Premier. With Premier you will be able to download information for dividends, interest, and sales and purchases of stocks, bonds, mutual funds, etc."

Sign up for a Slickdeals account to remove this ad.

You cannot purchase this product as this region is currently not supported. Any bundle discounts associated with this product will not be applied in this purchase.

Edit: Digital credit can be applied only to the one without $10 gift card.

Can someone re/confirm that I can use Deluxe to:

- Import (and manually enter if one of my brokerage - e.g. Webull or Coinbase isn't supported) all my stock, option, or crypto sales?

- Does it include and handle sale of ESPP shares from my employer? They do report the discount on W2 and also send Form 3922 to calculate the adjusted cost basis

- Does it include and handle rental property depreciation? I have previous calculations from past years that are carried forward from Schedule E.

- Lastly, does it include and handle Profit or Loss from Business (Schedule C) & Qualified Business Income deduction from Form 8995/8995-A?

Thanks in advance!https://www.amazon.com/gp/product/B0CNBLKJ9H

Sign up for a Slickdeals account to remove this ad.

Can someone re/confirm that I can use Deluxe to:

- Import (and manually enter if one of my brokerage - e.g. Webull or Coinbase isn't supported) all my stock, option, or crypto sales?

- Does it include and handle sale of ESPP shares from my employer? They do report the discount on W2 and also send Form 3922 to calculate the adjusted cost basis

- Does it include and handle rental property depreciation? I have previous calculations from past years that are carried forward from Schedule E.

- Lastly, does it include and handle Profit or Loss from Business (Schedule C) & Qualified Business Income deduction from Form 8995/8995-A?

Thanks in advance!Leave a Comment