EcoFlow Official Store via eBay has

EcoFlow DELTA Pro 3600Wh Portable LFP Power Station Generator (Certified Refurbished) on sale for $1,886.25 - 20% off when you apply promo code

LABORDAYOFF via checkout =

$1,509.

Shipping is free.

Thanks to Deal Hunter

Meowssi for sharing this deal.

Product Details:

- 3600Wh capacity

- LFP battery with 6500 cycles

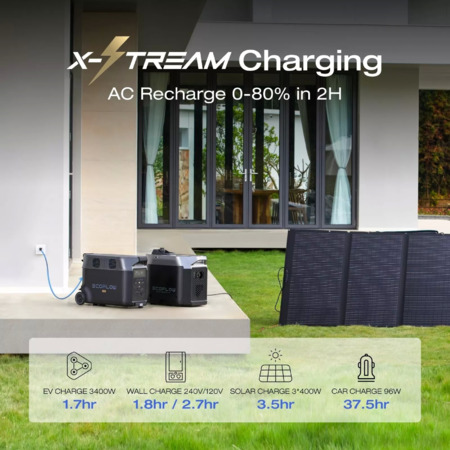

- Fully charge DELTA Pro from a standard AC wall outlet in 1.8 hours

- 5 AC outlets, 2 USB-C ports, 2 USB-A ports, 1 car outlet, 2 DC5521 Outputs, Anderson Port

- 1600W max solar input

- 5 outlets, 3600W total (Surge 7200W) AC Output

- Wi-Fi, Bluetooth, wired

- 99-lbs

Includes:

- DELTA Pro

- AC Charging Cable

- Car Charging Cable

- DC5521 to DC5525 cable

- Handle Cover

- User Manual

Leave a Comment

Top Comments

33 Comments

Sign up for a Slickdeals account to remove this ad.

Tax credit is for new/first install. The IRS site for the clean energy rebate clearly states "Used (previously owned) clean energy property is not eligible". The IRS probably wont know these are used. But, if your receipt states these are refurbished the IRS could deny the 30%.

https://www.irs.gov/credits-deduc...rgy-credit

Accountant referenced above is an idiot if they think refurbished isn't used and unless you can prove these are "first time" units (you can't) good luck arguing with the IRS.

Used (previously owned) clean energy property is not eligible.

These have been used. IRS also stated they will be aggressively cracking down on wrongful tax credit claims this year due to too many people incorrectly claiming.

You need a new accountant. There's a reason why when you file your taxes that your accountant completed, you have to sign documentation stating that the accountants is not held Responsible if there are any damages from incorrect filing.

Tax credit is for new/first install. The IRS site for the clean energy rebate clearly states "Used (previously owned) clean energy property is not eligible". The IRS probably wont know these are used. But, if your receipt states these are refurbished the IRS could deny the 30%.

https://www.irs.gov/credits-deduc...rgy-credit

Accountant referenced above is an idiot if they think refurbished isn't used and unless you can prove these are "first time" units (you can't) good luck arguing with the IRS.

Sign up for a Slickdeals account to remove this ad.

1. Ecoflow is selling them as refurbished. Literally means reconditioned to like-new (ie not new)

2. Ecoflow says they are "nearly new" in the listing = used

3. eBay has them as "certified" refurbished = used

4. Previous purchasers reviews show units "with only a few hundred charge cycles" which again confirms used.

"Refurbished units with a full factory warranty". What does that have to do with anything? They could have double the factory warranty who cares? Certainly not the IRS.

When others asked if these qualified for the tax credit you said "My accountant said yes they count as they are coming from the company itself". In what world does who shipped them make a difference in new vs used?

IRS - Are they new?

you - Great question. They came with a full warranty.

IRS - Cool. But are they new?

you - They are 'new refurbished'. Ebay/Ecoflow both recognize them as used, but I believe they're the same as new. Trust me.

IRS - So used. How would they qualify for the credit since our guidelines clearly state used property does not qualify?

you - I'm glad you asked. My accountant said since they were mailed by Ecoflow they qualify.

IRS -

you - Plus the internet said the IRS is unlikely to notice, so that's the same as it's fine.

IRS to Accountant - Can you explain?

Accountant - I don't actually exist. Made up on the internet for make-believe internet clout and rep points.

Until you come back with a link or some actual info that the IRS will consider refurbished equivalent to new- stop wasting peoples time with misinformation. And yes, based on what you wrote your "accountant" is most certainly an idiot.

1. Ecoflow is selling them as refurbished. Literally means reconditioned to like-new (ie not new)

2. Ecoflow says they are "nearly new" in the listing = used

3. eBay has them as "certified" refurbished = used

4. Previous purchasers reviews show units "with only a few hundred charge cycles" which again confirms used.

"Refurbished units with a full factory warranty". What does that have to do with anything? They could have double the factory warranty who cares? Certainly not the IRS.

When others asked if these qualified for the tax credit you said "My accountant said yes they count as they are coming from the company itself". In what world does who shipped them make a difference in new vs used?

IRS - Are they new?

you - Great question. They came with a full warranty.

IRS - Cool. But are they new?

you - They are 'new refurbished'. Ebay/Ecoflow both recognize them as used, but I believe they're the same as new. Trust me.

IRS - So used. How would they qualify for the credit since our guidelines clearly state used property does not qualify?

you - I'm glad you asked. My accountant said since they were mailed by Ecoflow they qualify.

IRS -

you - Plus the internet said the IRS is unlikely to notice, so that's the same as it's fine.

IRS to Accountant - Can you explain?

Accountant - I don't actually exist. Made up on the internet for make-believe internet clout and rep points.

Until you come back with a link or some actual info that the IRS will consider refurbished equivalent to new- stop wasting peoples time with misinformation. And yes, based on what you wrote your "accountant" is most certainly an idiot.

It's also up to you whether you want to keep arguing against that. The code just says that used doesn't qualify. It doesn't say anything about refurbished so we can just keep arguing about it until if it ever gets through a judge to decide who's right. It hasn't gotten there (I don't think it will) so I'm going with that it's a new refurbished unit.

It's also up to you whether you want to keep arguing against that. The code just says that used doesn't qualify. It doesn't say anything about refurbished so we can just keep arguing about it until if it ever gets through a judge to decide who's right. It hasn't gotten there (I don't think it will) so I'm going with that it's a new refurbished unit.

Refurbished is 100% a used product. Its not an opinion. In fact, its been legally decided many times. There are deception laws that bar manufacturers from selling used, refurbished products as new. Using ANY used parts to make a "new" product is specifically outlined as a violation of the FTC act if the product is sold as "new". If Ecoflow could they would but they cannot label it as "new" without significant repercussions. Here is the case law.

https://www.ftc.gov/enforcement/p...66%20F.T.C.

The only reason no one would rule on this again is no one is arguing used products, sold as used products, clearly labeled as used products, are new. No attorney would take you on as a client and the IRS will just fine you and asses penalties as they require "new" (they don't need to sue you or a judgement to act).

I'm honestly not sure how you could be more wrong here. At least arguing the IRS likely wont notice has some truth to it, even if it is bad advice in general.

My point was i wouldnt buy a unit that likely already failed, and does not qualify for the 30% federal credit. Look elsewhere and/or wait.

$1519 after code: FALL20OFF

Sign up for a Slickdeals account to remove this ad.

Leave a Comment