This popular front-page deal is available again.

CINCOM via Amazon has

4-Zone CINCOM Cordless Battery-Powered Leg Massager Recovery System (various sizes, CM-108A) on sale for $499.99 - $360 when you apply promo code

HTOZ73KR at checkout =

$139.99.

Shipping is free.

Thanks to Deal Editor

iconian for sharing this deal.

Available sizes:

Features:

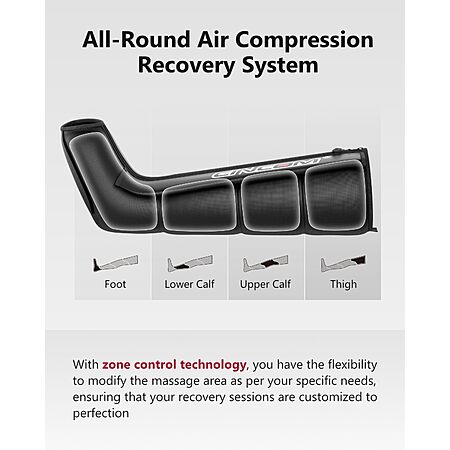

- 360° dynamic air compression utilizing an enlarged air pump to provide a soothing massage experience, effectively alleviating leg fatigue, improving circulation, and reducing symptoms of RLS, lymphedema, and swelling

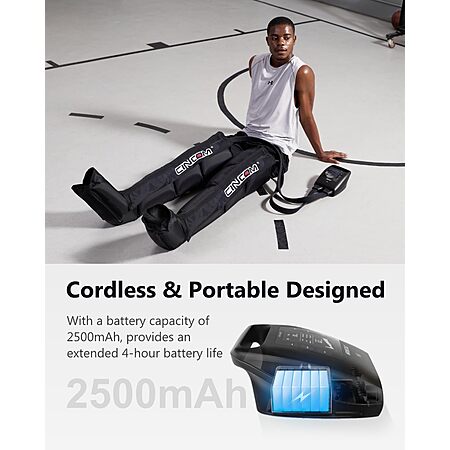

- Cordless & Portable Design. Featuring a high-capacity battery that delivers 3-4 hours of lasting power on a full charge, it comes with a convenient carrying bag for easy use to the gym, office, or outdoors

- 12 Intensities, 3 Modes, & 10 Adjustable Timers

- Experience targeted relief with innovative zone control technology, allowing you to adjust pressure and duration for specific areas (feet, lower calf, upper calf, thigh).

Leave a Comment

Top Comments

https://www.costco.com/p/-/sharpe...ue&nf=

71 Comments

Sign up for a Slickdeals account to remove this ad.

Edit: I mean HSA.

I don't think many employers give you you a chance to pick fsa vs HSA. Mine doesn't but they picked HSA for us which is good.

Edit: I mean HSA.

* Note: assuming you can invest into same assets and have similar fees.

from Chatgpt....

Which Is Better for Leg Recovery?

✔️ Better Customization & Overall Recovery Power — Amazon CINCOM

More intensity levels and modes — better for targeting different recovery needs.

Amazon

Cordless portability — use it anywhere, not tied to an outlet.

Amazon

Good choice if you plan to use it often, want adjustable therapy, or want a more comprehensive compression system.

✔️ Better Simplicity & Budget Option — Costco Sharper Image

Great if you just want a basic compression boot for occasional use at home.

Costco Wholesale

Less intense and fewer features, but decent for the price.

✅ Recommendation: If your priority is better recovery performance, more control, and portability, the Amazon CINCOM system is a stronger value despite being slightly more expensive.

If you want simple, occasional use, the Costco Sharper Image boots are fine.

Note: Neither of these are top-tier professional boots (e.g., Hyperice Normatec series), which rank higher for serious athletes according to compression boot reviews. If recovery is a huge priority and budget allows, you might want to consider premium models, but for mainstream home use, the above comparison should help you decide.

* Note: assuming you can invest into same assets and have similar fees.

When you are investing into a standard post tax account, you will also be taxed again for the gains you have made? How is that mathematically better than letting it grow and withdrawing later tax free for the same purchase?

Sign up for a Slickdeals account to remove this ad.

When you are investing into a standard post tax account, you will also be taxed again for the gains you have made? How is that mathematically better than letting it grow and withdrawing later tax free for the same purchase?

How will it be equivalent if you are taxed eventually? Let's say you make a $100 purchase on HSA (I am not even going to take into account that $100 was pre tax for simplicity sake). You take that 100 that you didn't have to use to purchase and invest it. Let's say it grows by 100% over 7 years. You now have $200 but now when you go to withdraw it, you will be taxed, so maybe 15% tax bracket, you get $185. If you instead left it in HSA it grows to 200. When you want to withdraw it, you can submit the charge from it without being taxed, so you withdraw the $100 cost and have $100 more in your account (assuming the same growth) for other medical expenses. Now factor in the fact that the $100 in your scenario would have been post tax so you are double taxed.

Too many injuries + dr. visits = standard insurance

How will it be equivalent if you are taxed eventually? Let's say you make a $100 purchase on HSA (I am not even going to take into account that $100 was pre tax for simplicity sake). You take that 100 that you didn't have to use to purchase and invest it. Let's say it grows by 100% over 7 years. You now have $200 but now when you go to withdraw it, you will be taxed, so maybe 15% tax bracket, you get $185. If you instead left it in HSA it grows to 200. When you want to withdraw it, you can submit the charge from it without being taxed, so you withdraw the $100 cost and have $100 more in your account (assuming the same growth) for other medical expenses. Now factor in the fact that the $100 in your scenario would have been post tax so you are double taxed.

You can only use it for medical expenses but you can withdraw from it for medical expenses without expiration of time period. In other words, you can make a purchase when you are 40 with your regular post tax money but don't withdraw that amount from your HSA until you are say 63 as long as you keep your receipt. So the use of post tax money is more than balanced and then some by the withdrawal from it 23 years later tax free.

You can only use it for medical expenses but you can withdraw from it for medical expenses without expiration of time period. In other words, you can make a purchase when you are 40 with your regular post tax money but don't withdraw that amount from your HSA until you are say 63 as long as you keep your receipt. So the use of post tax money is more than balanced and then some by the withdrawal from it 23 years later tax free.

Sign up for a Slickdeals account to remove this ad.

Leave a Comment