- MySavingsDirect (Emigrant Bank) [mysavingsdirect.com] - 4.35%

- Merchants Bank of Indiana [merchantsbankofindiana.com] - 4.34%

- Bask Bank [baskbank.com] - 4.25%

- UFB Direct [ufbdirect.com] - 4.21%

- Upgrade Premier [upgrade.com] - 4.13%

- Salem Five Direct [salemfivedirect.com] - 4.10%

- Capital One 360 Savings [capitalone.com] - 3.4%

- Robinhood Gold [robinhood.com] - 3.75% w/ $5/mo membership (Can't verify)

This post can be edited by most users to provide up-to-date information about developments of this thread based on user responses, and user findings. Feel free to add, change or remove information shown here as it becomes available. This includes new coupons, rebates, ideas, thread summary, and similar items.

Leave a Comment

Top Comments

The point I'm making is, if the Fed meets expectations (currently 50bps-50bps-25bps-pause) over the next 4 meetings, the rates will theoretically stay where they are.

To use a real-world example, it's the same reason why mortgage rates have been rising gradually and why they didn't suddenly rise 75bps yesterday or today upon the Fed hike announcement. It's because it was already priced in.

Edit: Note, I'm leaving quite a bit of nuance and detail out of this and am not picking on you in particular. I just see quite a bit of misunderstanding about how consumer interest rate products react to Fed overnight rate hikes and when.

Source: Work in finance

351 Comments

Sign up for a Slickdeals account to remove this ad.

I found that vanguard settlement fund beats online savings

I have an email from Wealthfront stating the fact it will be 3.3 at some point today..

I found that vanguard settlement fund beats online savings

how are they so inept that all these banks are offering 3.3% interest but not even advertising it?

are you sure you're getting 3.3% with them?

DollarSavingsDirect.com

Source: also work in finance

17 weeks is running for 4.28 which will increase more after Dec hike for sure.

https://www.treasurydirect.gov/au.../upcoming/ [treasurydirect.gov]

Sign up for a Slickdeals account to remove this ad.

17 weeks is running for 4.28 which will increase more after Dec hike for sure.

https://www.treasurydirect.gov/au.../upcoming/ [treasurydirect.gov]

Not that I disagree with buying t-bills as an alternative here.

The point I'm making is, if the Fed meets expectations (currently 50bps-50bps-25bps-pause) over the next 4 meetings, the rates will theoretically stay where they are.

To use a real-world example, it's the same reason why mortgage rates have been rising gradually and why they didn't suddenly rise 75bps yesterday or today upon the Fed hike announcement. It's because it was already priced in.

Edit: Note, I'm leaving quite a bit of nuance and detail out of this and am not picking on you in particular. I just see quite a bit of misunderstanding about how consumer interest rate products react to Fed overnight rate hikes and when.

Source: Work in finance

Each time the Fed raises, my rate goes up typically within a week. I may not get the full 0.75% bump that the Fed processes, but I always get a bump (although my most recent bump was the full 0.75%).

Bonds are a whole other animal and they are actively traded on a large market. They are anticipatory because people will trade them based on future expectations of monetary and, to a lesser extent, fiscal policy. Savings account interest rates do not trade on an open market, rather they are tied to the federal funds rate which is the rate that banks pay for overnight lending (necessary to meet reserve requirements set by the Fed). If the Fed raises those rates, or lowers them, it has direct implications for what you see in your savings account rate.

3 month treasuries are above 4% now. 2 year CDs will pay 5%. There's a really narrow niche of people who are well served by choosing a savings account over a CD or a treasury right now.

Each time the Fed raises, my rate goes up typically within a week. I may not get the full 0.75% bump that the Fed processes, but I always get a bump (although my most recent bump was the full 0.75%).

Bonds are a whole other animal and they are actively traded on a large market. They are anticipatory because people will trade them based on future expectations of monetary and, to a lesser extent, fiscal policy. Savings account interest rates do not trade on an open market, rather they are tied to the federal funds rate which is the rate that banks pay for overnight lending (necessary to meet reserve requirements set by the Fed). If the Fed raises those rates, or lowers them, it has direct implications for what you see in your savings account rate.

There are countless reddit threads across various subs asking whether they should lock in a mortgage rate the day before the FOMC thinking they'll get a mortgage rate the exact bps lower than the Fed is hiking. And those posts aren't universally corrected. It's a real issue in financial literacy and this extends to savings accounts.

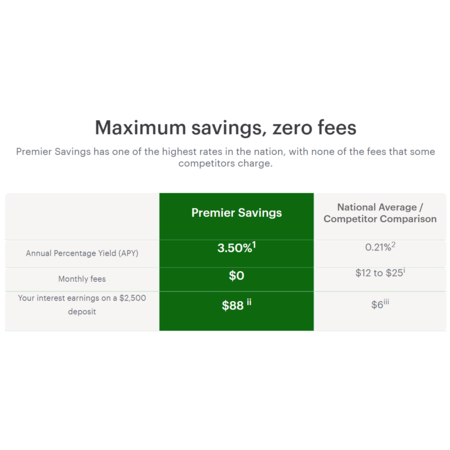

Savings Account for 3% APY [capitalone.com]

Sign up for a Slickdeals account to remove this ad.

Leave a Comment