Costco Wholesale has for its

Members:

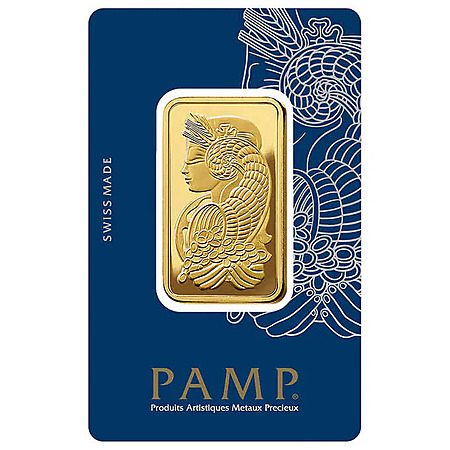

1 Troy Ounce Gold Bar PAMP Suisse Lady Fortuna Veriscan (New In Assay) for

$2029.99.

Shipping is free.

Thanks community member

chemman14 for sharing this deal

Note, you must be an active Costco Member signed into your account to view sale price and purchase. Limit of 2 per membership. Item is non-refundable. Item is not eligible for price adjustments.

About this Product:

- 1 Troy Ounce 999.9 fine gold minted bar with a proof-like finish

- Swiss-made by a LBMA Good Delivery Refiner

- VERISCAN Bullion Identification Security System & iPhone App

- Carbon Neutral certified by the Carbon Trust in accordance with the international PAS 2060 Carbon Neutrality Standard, identified by a 'footprint' label

- Each bar is individually controlled, registered, and secured within protective CertiPAMP packaging with an official Assay Certificate and a digital certificate accessed with a QR Code. Each assay card is covered with a thin removable protective film

Veriscan Technology:

- PAMP Suisse's exclusive Veriscan technology uses the metal's microscopic topography, like a fingerprint, to identify any registered product, aiding in the detection of counterfeits. Each bar is scanned upon production and when scanned by the customer, is further verified by the Veriscan database. Veriscan is available as a creative and convenient mobile app, or as a PC software system for use with a traditional document scanner and the PAMP bullion-positioning frame.

Leave a Comment

Top Comments

https://noblegoldinvest

Alabama: No sales tax on bullion

Alaska: No sales tax at a state level

Arizona: No sales tax on bullion

Arkansas: 6.5% on all precious metal sales

California: 7.5% on transactions below $1,500

Colorado: No sales tax on most precious metals

Connecticut: 6% on purchase values below $1,000

Delaware: No sales tax

Florida: 6% on values below $500, with an exemption for legal tender

Georgia: No sales tax

Hawaii: 4% general excise tax paid by the seller, often added to the purchase price

Idaho: No sales tax

Illinois: 6.25% on South African Krugerrands only, all other bullion is exempt

Indiana: No tax on high-purity bullion, 7% on other types of precious metal

Iowa: No sales tax

Kansas: No sales tax

Kentucky: 6% on all orders

Louisiana: No tax on precious metals

Maine: 5% flat rate

Maryland: 6% on order values below $1,000

Massachusetts: 6.25% on transactions below $1,000

Michigan: No sales tax on high-purity bullion

Minnesota: 6.88%

Mississippi: 7%

Missouri: No sales tax on high-purity bullion

Montana: No sales tax

Nebraska: No sales tax

Nevada: 6.85% with some exemptions

New Hampshire: No sales tax

New Jersey: 7%

New Mexico: 5% paid by the seller

New York: 4% on transactions below $1,000

North Carolina: No sales tax

North Dakota: 5%, but with high-purity bullion exempt

Ohio: Basic sales tax of 5.75% applies to silver and gold bezels, high-purity bullion is exempt

Oklahoma: No sales tax on precious metals

Oregon: No sales tax on any precious metals purchase

Pennsylvania: 6% on silver and gold coins which are not legal tender, bullion is exempt

Rhode Island: 7% tax applies only to bullion that's not been refined or smelted

South Carolina: Most precious metals are exempt, but some coins and processed items attract 6%

South Dakota: No sales tax on investment-grade bullion or legal tender

Tennessee: No sales tax on gold or silver bullion

Texas: No sales tax on gold or silver bullion

Utah: A 4.75% tax applies to bullion with purity below 50%

Vermont: 6% on all precious metal transactions

Virginia: 5.3% levied on all precious metals with no exemptions

Washington: No tax on any non-collectible precious metals

West Virginia: Investment-grade bullion and coins are tax-exempt

Wisconsin: A 5% tax on all precious metal purchases

Wyoming: A basic 4% rate on all precious metal purchases

95 Comments

Sign up for a Slickdeals account to remove this ad.

Some people buy to more or less hold, but it seems a common tactic on SD is to buy and flip immediately. Basically you're scraping CC and executive cash back if you can sell for whatever you paid for them. the major issue being that spot varies so much you could find yourself losing money on top of your CC benefits.

Sign up for a Slickdeals account to remove this ad.

https://www.costco.com/1-oz-gold-...86760.html

Our community has rated this post as helpful. If you agree, why not thank Dr. J

Check your state.

https://noblegoldinvest

Alabama: No sales tax on bullion

Alaska: No sales tax at a state level

Arizona: No sales tax on bullion

Arkansas: 6.5% on all precious metal sales

California: 7.5% on transactions below $1,500

Colorado: No sales tax on most precious metals

Connecticut: 6% on purchase values below $1,000

Delaware: No sales tax

Florida: 6% on values below $500, with an exemption for legal tender

Georgia: No sales tax

Hawaii: 4% general excise tax paid by the seller, often added to the purchase price

Idaho: No sales tax

Illinois: 6.25% on South African Krugerrands only, all other bullion is exempt

Indiana: No tax on high-purity bullion, 7% on other types of precious metal

Iowa: No sales tax

Kansas: No sales tax

Kentucky: 6% on all orders

Louisiana: No tax on precious metals

Maine: 5% flat rate

Maryland: 6% on order values below $1,000

Massachusetts: 6.25% on transactions below $1,000

Michigan: No sales tax on high-purity bullion

Minnesota: 6.88%

Mississippi: 7%

Missouri: No sales tax on high-purity bullion

Montana: No sales tax

Nebraska: No sales tax

Nevada: 6.85% with some exemptions

New Hampshire: No sales tax

New Jersey: 7%

New Mexico: 5% paid by the seller

New York: 4% on transactions below $1,000

North Carolina: No sales tax

North Dakota: 5%, but with high-purity bullion exempt

Ohio: Basic sales tax of 5.75% applies to silver and gold bezels, high-purity bullion is exempt

Oklahoma: No sales tax on precious metals

Oregon: No sales tax on any precious metals purchase

Pennsylvania: 6% on silver and gold coins which are not legal tender, bullion is exempt

Rhode Island: 7% tax applies only to bullion that's not been refined or smelted

South Carolina: Most precious metals are exempt, but some coins and processed items attract 6%

South Dakota: No sales tax on investment-grade bullion or legal tender

Tennessee: No sales tax on gold or silver bullion

Texas: No sales tax on gold or silver bullion

Utah: A 4.75% tax applies to bullion with purity below 50%

Vermont: 6% on all precious metal transactions

Virginia: 5.3% levied on all precious metals with no exemptions

Washington: No tax on any non-collectible precious metals

West Virginia: Investment-grade bullion and coins are tax-exempt

Wisconsin: A 5% tax on all precious metal purchases

Wyoming: A basic 4% rate on all precious metal purchases

Sign up for a Slickdeals account to remove this ad.

Leave a Comment