You might also have 6x cashback from your Amex card, if you are targeted: https://offer.love/?search=amazon.

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

Item 1 of 1

expiredjohnny_miller | Staff posted Dec 27, 2023 08:14 AM

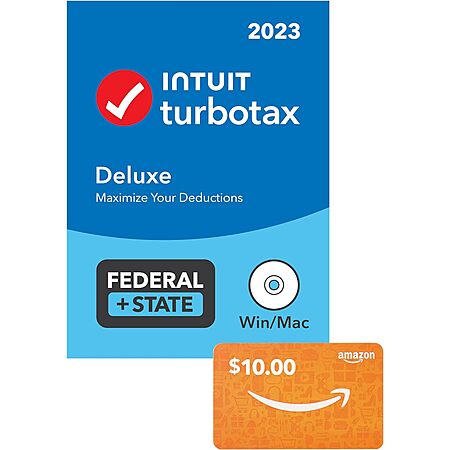

TurboTax Deluxe + State 2023 + $10 Amazon Gift Card (PC/Mac Physical Disc)

& More + Free Shipping$45

$80

43% offAmazon

Visit AmazonGood Deal

Bad Deal

Save

Share

Leave a Comment

Top Comments

Gotta love our corrupt system, causing people to spend millions of extra dollars and God knows how many man-hours filing tax returns that really have no reason to exist in this day and age.

191 Comments

Sign up for a Slickdeals account to remove this ad.

Sign up for a Slickdeals account to remove this ad.

Can someone re/confirm that I can use Deluxe to:

- Import (and manually enter if one of my brokerage - e.g. Webull or Coinbase isn't supported) all my stock, option, or crypto sales?

- Does it include and handle sale of ESPP shares from my employer? They do report the discount on W2 and also send Form 3922 to calculate the adjusted cost basis

- Does it include and handle rental property depreciation? I have previous calculations from past years that are carried forward from Schedule E.

- Lastly, does it include and handle Profit or Loss from Business (Schedule C) & Qualified Business Income deduction from Form 8995/8995-A?

Thanks in advance!Sign up for a Slickdeals account to remove this ad.

Leave a Comment